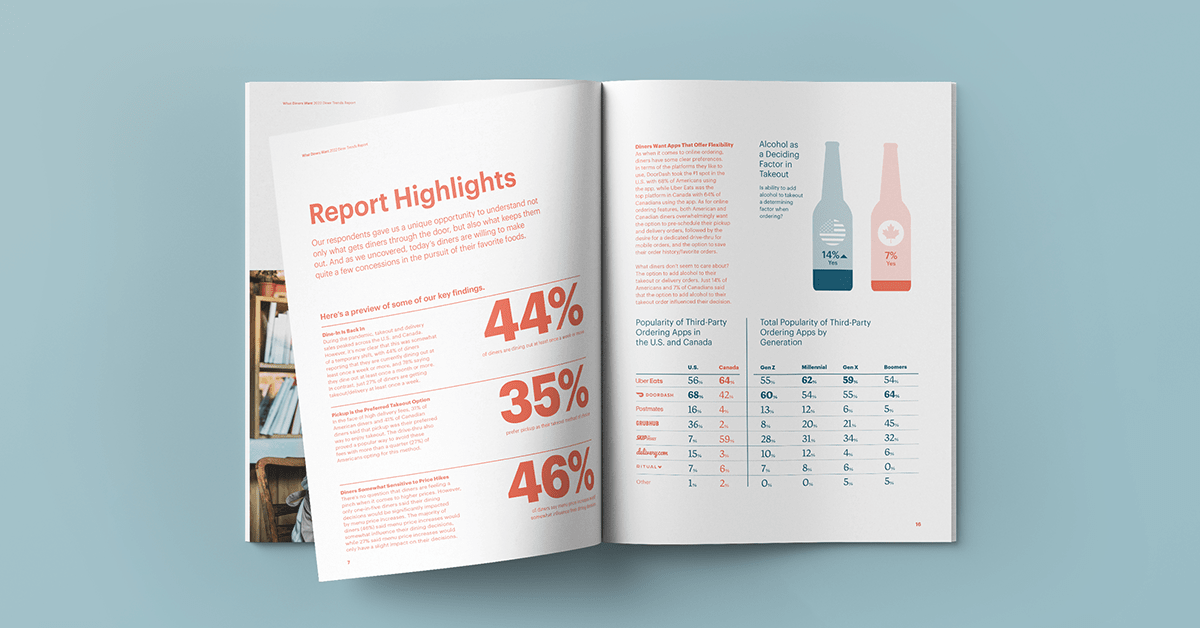

NEW YORK and TORONTO – September 14, 2022 – Research released today from TouchBistro finds that despite the pandemic causing a boom in takeout and delivery, diners in the U.S. and Canada still prefer the experience of dining in – especially at local restaurants. According to the TouchBistro 2022 Diner Trends Report, 44% of diners currently dine in at least once a week or more, while 78% dine in at least once a month or more. In contrast, less than one-third (27%) get takeout or delivery at least once a week. Nearly two-thirds (63%) choose local, independent restaurants over chains or franchises.

According to the survey research conducted by Maru Matchbox on behalf of TouchBistro of more than 2,600 diners from across the U.S. and Canada, the quality of food tops everything when dining in. Two-thirds (68%) rank the quality of food as the most important factor when deciding where to dine, followed by location (66%), customer service (64%), price (62%), and safety/hygiene (61%). Diners rank dietary-specific menus (19%), live music/DJs (11%), and QR code menus (10%) as the least important factors influencing their dining decisions.

“Our research shows that the pandemic hasn’t permanently changed habits among diners and that’s good news for today’s restaurateurs. While innovations have made it easier to order takeout, it’s clear that convenience hasn’t replaced the desire to dine in,” says Samir Zabaneh, CEO of TouchBistro. “Restaurants need to return to the key actions they know worked before the pandemic and that their customers loved, as these go a long way in building customers for life.”

How diners decide

The research finds that diners follow their cravings when deciding where to eat. The majority (72%) choose where they want to dine based on what kind of food they want to eat. In fact, for three-quarters of Millennials, Gen Xers, and Boomers, the type of food a restaurant offers is their number one deciding factor.

Whether they’re dining out at a restaurant or ordering takeout, most diners do exactly the same thing before they order: check out the restaurant’s menu online. Browsing the menu ahead of time is a cornerstone of current dining habits and one of the biggest digital trends in foodservice. 84% of restaurant goers always or often look up a restaurant menu ahead of time, and 79% always or often look at a restaurant’s website.

What keeps diners away

The study finds that a bad reputation is much more likely to turn diners off than high prices. Though the majority of diners are no longer concerned with pandemic-related safety protocols, health and hygiene is still very much on diners’ minds. 73% say a recent health inspection warning would deter them from visiting a restaurant, making it the number one reason customers avoid certain venues.

Distance and negative feedback were also major deterrents, with 61% saying a distance greater than 30 miles would keep them away and 59% saying negative feedback from a friend would be a major deterrent.

How diners engage

There are clear signs that loyalty programs are an untapped asset that could help restaurants drive repeat visits. While only 36% of American diners and 23% of Canadian diners say they are currently part of a restaurant loyalty program, more than three-quarters (86%) of diners displayed interest in joining a loyalty program if it provided them with access to discounts and coupons for free items. 85% also expressed interest in a rewards program that would allow them to earn free items. And among those who are part of loyalty programs, one-third (32%) say they engage with loyalty programs weekly or more often.

Loyalty programs aren’t the only way that diners engage with their favorite restaurants. 50% of diners report that email is their preferred way to stay in touch with restaurants. And while email is the most preferred form of communication across generations, 20% of Gen Z diners in the U.S. and 13% in Canada prefer to hear from restaurants via social media.

Emerging trends from the 2022 Diner Report

As diners return to dining-in, other trends are just beginning to take shape. A closer look at the findings from the study reveals hidden trends that will be pivotal in the years ahead.

1. Moderate Menu Price Sensitivity:

Inflation has skyrocketed, making consumers increasingly sensitive to price increases in all aspects of their lives, including dining in. For some diners, this means menu price hikes could be a major deterrent, with around one-in-five diners (22%) saying that a price increase would significantly impact their decision to visit a restaurant. However, it’s also clear that consumers love restaurants and are willing to make room in their budget for dining in. Nearly half of diners – 45% of Americans and 47% of Canadians – say that menu price increases would only somewhat impact their decision to visit a restaurant, suggesting that diners are willing to absorb some menu price increases to enjoy the food they love.

2. Hidden Potential of Loyalty Programs:

While joining a restaurant loyalty program is not yet the norm for the majority of diners, a closer look at the data reveals that these programs may be poised for a major surge in popularity. Younger diners and diners who order takeout/delivery are embracing loyalty programs with open arms. In fact, a whopping 40% of Gen Z and 41% of Millennials diners in the U.S. are already members of a restaurant rewards program, suggesting that younger diners are much more likely to join these programs and expect them to be a part of their everyday dining experience. And among diners who order takeout weekly or more, more than half of American (58%) and Canadian (56%) diners engage with loyalty programs at least once a week.

3. Demand for Online Ordering Innovations:

While dining in is the preferred way to visit restaurants, this does not mean that takeout and delivery are no longer a vital sales channel for restaurants. On the contrary, 29% of Americans and 25% of Canadians say they still order takeout and delivery at least once a week or more often, which represents a huge piece of the pie for restaurant sales. Convenience is still the main driver behind off-premise orders, while the biggest deterrent is high delivery fees.

4. Online Influencers and Their Growing Influence:

A closer look at Gen Z’s dining habits suggests that social media and online influencers may increasingly play a role in restaurant decisions. 28% of Gen Z said that social media influences where they decide to dine and a whopping 39% of Gen Z diners say that they have tried a new restaurant based solely on the recommendation of an online influencer. Instagram appears to be the most influential platform for this generation, but TikTok is on the rise. In the U.S. one-in-five (21%) Gen Z diners turn to TikTok before dining out.

Complete Report Available The “2022 Diner Trends Report” can be downloaded for free at https://www.touchbistro.com/blog/diner-trends-report/

TouchBistro is an all-in-one POS and restaurant management system that makes running a restaurant easier. TouchBistro is built to meet the unique needs of the restaurant industry, helping restaurateurs streamline and simplify their operations with the most essential front of house, back of house, and customer engagement solutions on one powerful platform. TouchBistro is fast, reliable, and easy to use, and has all of the features restaurateurs need to increase sales, deliver a great guest experience, and save both time and money. By pairing innovative restaurant technology with an unparalleled dedication to customer support and success, TouchBistro has powered more than 29,000 restaurants in over 100 countries, and is a global leader changing the way restaurateurs do business. For more information about TouchBistro, visit touchbistro.com.