A few decades ago, full-service restaurant managers and owners often greeted customers at the door, shaking their hands and checking reservations in a book at the front desk. But today, many restaurants are quickly phasing out these analog operations due to ongoing labor pressure.

So what's filling the gap left behind by these human interactions? For a growing number of restaurants, it's robots, QR codes and self-order kiosks. But interest in labor light or labor-free solutions appears to eclipse actual implementation among operators.

Ninety-one percent of restaurants believe automation geared toward inventory would be a key use case, and 62% feel it would help better manage online, dine-in and delivery orders, according to Square's Future of Restaurants: 2022 report. Despite this sentiment, only 36% of these respondents have upgraded their business technology in the last year.

"The hospitality industry has been a late adopter in many ways to the technology trends that other industries and other markets have seen such progress [in]," Stephen Mancini, senior manager of strategy, technology and transformation at CohnReznick, said.

There's reason to be cautious when it comes to investing in new technologies however. Many restaurants, especially independent operators, are struggling to protect their margins amid rising food costs, increased wages and a lack of federal support. Cutting-edge tech solutions can be expensive, and SevenRooms CEO Joel Montaniel advises restaurants to do their research and ensure they comprehend the full benefits of the technology they are interested in.

"Make sure you understand what the true cost is to use that platform," he said. "Whether that's the cost that you pay to get what you get, or whether that's the ability to integrate into things you care about or the ability to support your business."

There's a host of technologies that can optimize various aspects of restaurant business and make the challenges of the current landscape more manageable. Not sure what's right for your operation? Explore some of the most popular technology investments among restaurants below.

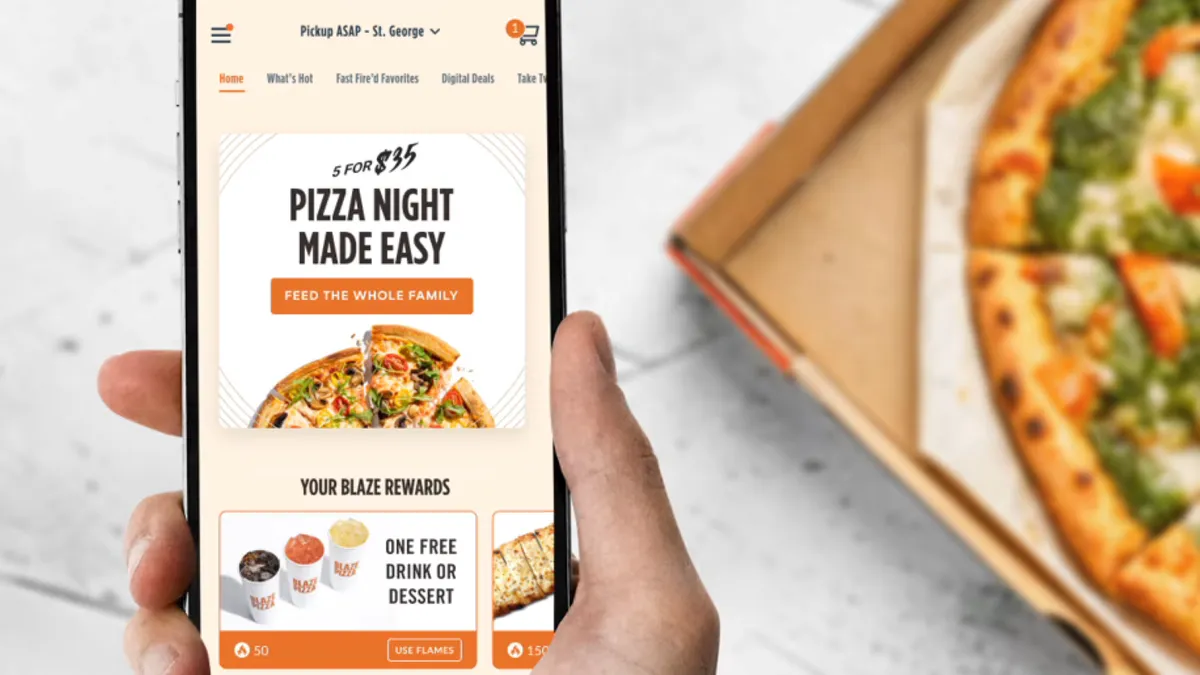

Mobile apps that connect to back-of-house tech

Prior to the pandemic, the focus of a restaurant's mobile app was limited to improving connections between a brand and its customers, enhancing marketing and reducing pressure on front-of-house staff, Nick Cole, head of restaurant finance at MUFG Americas, said.

Now, in order to optimize throughput and guarantee convenient and efficient service, mobile apps need to coordinate with kitchen technology to ensure orders are fulfilled on time, Cole said. This also means apps need to integrate with third-party delivery partners. Shake Shack, for example, added in-app delivery ordering in 2021 that allows diners to track their orders in real time.

Fast food chains are also starting to use advanced logistics to figure out where a customer or delivery courier is located and then notify the staff on when they should start the order, Jim Balis, managing director of CapitalSpring's strategic operations group, said. This data ties to Google Maps or Waze or other location services, he said. Taco Bell's Go Mobile stores, for example, will track a customer who orders through its app and have their orders waiting for them at the drive-thru upon their arrival.

While QSRs with drive-thrus thrived in the early days of the pandemic, fast casuals with good apps, efficient kitchens and delivery models became just as convenient as restaurants with drive-thrus — even without drive-thrus, Cole said. Panera added dine-in mobile ordering to its app in February, for example, allowing customers to order from their tables and receive alerts on their phones when their orders are ready.

"How technology in the back-of-house has married up with that front-end technology of the app ordering system [has] completely changed the landscape for some businesses and it's been a real separator for companies that have outperformed in this environment," Cole said.

QR codes

While many restaurants added QR codes to their tables to eliminate high-touch menus after the pandemic began, 45% of restaurants say they plan to offer QR codes for menus after the COVID-19 crisis ebbs, according to Square.

"Interestingly the initial driver for much of this innovation — COVID — isn't even why it may stick around. QR codes at tables and new ways to serve customers will actually be driven by labor shortages and rising prices," Aman Narang, COO, president and co-founder at Toast, said in an email.

QR codes will likely become increasingly common at full-service restaurants since they can alleviate common inefficiencies, such as customers needing to flag down wait staff to order and pay. Using QR codes could help servers to focus on bringing food and drinks to tables rather than spending time taking orders and processing payments. This switch could allow wait staff to manage seven to 10 tables instead of four, Balis said.

"[QR codes are] something that's going to continue to evolve into not just ordering, but also payment and other factors," Balis said.

QR codes are also replacing tabletop ordering technology, which are becoming a bit outdated, Balis said. Restaurants would offer limited menus and games guests could pay for, which would help cover the cost of operating the device. But as more people began playing games on their phones, guests weren't using the devices in that way, Balis said.

Datassential found 58% of consumers would like the option of using a QR code to pay at a restaurant or grocery store. Among consumers who have used them, 70% said they had a positive experience, per the research.

"People are just more comfortable using their phones," Balis said.

Self-order kiosks

Kiosk ordering at fast casual restaurants and QSRs is becoming more commonplace, especially in airports, Balis said. McDonald's Restaurant of the Future remodels, which included new digital kiosks, are emblematic of this trend.

This technology allows customers to place orders through a simple interface that features menu pictures and allows for customization, Balis said, which can increase efficiency. These units also help with the current labor crunch. Instead of having three people working at the cash register, a restaurant could have just one staff member on standby in case a customer needs help with ordering.

Kiosks also have flexible payment options — chains can either pay for the units they need up front or pay a few hundred dollars a month through a subscription to cover the cost. This cost would eventually be recouped through reduced labor needs, Balis said.

"You could have three or four kiosks, which ultimately may even be replaced by a phone and you walk in and it recognizes you or [it] may bring up your whatever you ordered last time … and then the restaurant doesn't even have to invest in the hardware for the kiosks," Balis said.

Some restaurants could eventually forgo kiosks entirely as apps become more advanced and better coordinate with kitchen systems and third-party delivery, as well as notify customers when their orders are ready.

"You're really behind if you don't have a good user-friendly, useful interactive app," Cole said.

Kiosks could still be attractive ordering technology in the future, however, because their larger screens allow restaurants to better promote menu items, Balis said.

Drive-thru automation

Customers will increasingly order at the drive-thru with voice automation technology that is similar to Apple's Siri functionality, Balis said.

"I think that's going to take over pretty quickly," Balis said. "We see some technology around that that's really good actually. … Not only does it [try to] upsell 100% of the time to larger bundles or add a drink or dessert or whatever, but it also has technology now that … says people ordered these combinations of items are more inclined to accept upsells of this incremental item X, Y or Z. The algorithms around that have been pretty successful."

Companies are also developing face recognition technology that recognizes patrons at the drive-thru, shows them their past orders and allows them to pay with their faces, Balis said.

Fair Oaks Burger in Altadena, California, for example, has been testing facial recognition that allows customers to pay without using cash or a credit card. Customers simply ask to use PopPay and a camera takes their photos and then charges guests' account. PopPay, which is part of PopID, started out as a facial recognition system to help speed up the checkout process at kiosks located within CaliBurger.

Deli Time, Dairi-O, Port of Subs Belcamp and Bojangles have been piloting similar PopID technology, according to Hospitality Technology.

Robots and artificial intelligence in the kitchen

While the industry is likely years away from robots taking a significant role in restaurants, many major chains continue to test different ways to deploy them in the back of house to save on labor costs. Chipotle partnered with Miso Robotics in March to test an autonomous kitchen assistant that can cook and season tortilla chips, while White Castle is expanding its partnership with Miso, which developed Flippy 2 to work a fry station, to 100 more locations.

Bear Robotics, which provides restaurants with food runner robots, secured $81 million in funding in March. It plans to use the additional funding to add products that will automate tasks in hospitality. The company's robots have already been used at Denny's and Chili's units.Chili's expanded its partnership with Bear Robotics in April to bring Rita the Robot to 51 additional locations after its initial 10-location test.

Robotics are particularly ideal in helping with singular tasks, and Balis has been advising robotics companies to not overly complicate use cases, he said. For example, robots can help increase order accuracy and consistency in food assembly like with pizzas and placing the exact amount of cheese or other ingredients, which could reduce food waste, but let the human put the pizza in the oven, Balis said.

But it may be some time before robotics are widely seen across the industry, Mancini said.

"I haven't seen anything that's a catalyst for a burst in application, nor have I seen anything as a deterrent," Mancini said. He added that some restaurants might implement a combination of self-order kiosks or different technology that automates payment at the front of the house and back-of-house automation, including robotics. Right now, companies are still determining if these technologies will drive value and better streamline operations, Mancini said.

Computer vision, which uses up to 50 cameras to monitor operations and notify staff of inaccurate orders, is also expanding within the restaurant space. This technology can also monitor team members over time, gathering data on how they work together and providing analytics on who works well together in which positions, Balis said, which could also improve back-of-house efficiency.

A growing number of computer vision companies are entering the foodservice space.

Lifestream AI entered the U.S. in April to help restaurants and hospitality industries analyze on-site and off-premise consumer behavior. Presto also offers camera technology through its Vision product that identifies throughput and order accuracy issues, which can also be applied to drive-thrus. Agot AI, which uses computer vision in the kitchen and drive-thru, secured $10 million in funding last year.

Operators put data to work

Among the biggest shifts within restaurant data usage and strategy will be a focus on financial planning and analysis tools. These capabilities allow an organization to run simulations to better understand the impact of disruptions like weather or supply chain. Operators can do scenario forecasting to better understand potential positive or negative impacts on the company, Mancini said.

If a restaurant wants to increase its off-premise sales by a certain percentage, for example, it can see how many staff members may be needed to hit this benchmark.

The next stage of customer engagement and loyalty will be ushered in by better understanding customer habits and integration of that data into one single-stack solution, Mancini said. Aggregated data could provide better insights into how customers react to marketing and what kind of impact campaigns have on revenue, he said.

"There's opportunity for real enhancement of the loyalty space and customer engagement and that frictionless checkout component," Mancini said. A combination of accessing loyalty points, checking out at a table and removing the payment processing aspects of the customer experience are real opportunities going forward, he said.

Geofencing to target consumers in specific market areas or on-premise with marketing could also become more common, Mancini said. For example, restaurants can use tracking data to understand on what day and time customers visited a specific location and then send out push notifications at that same time on a subsequent day to inform the customer of new offers or ask them if they'd like to order something that day, he said.

Correction: A previous version of this story misspelled SevenRooms CEO Joel Montaniel's name.