Dive Brief:

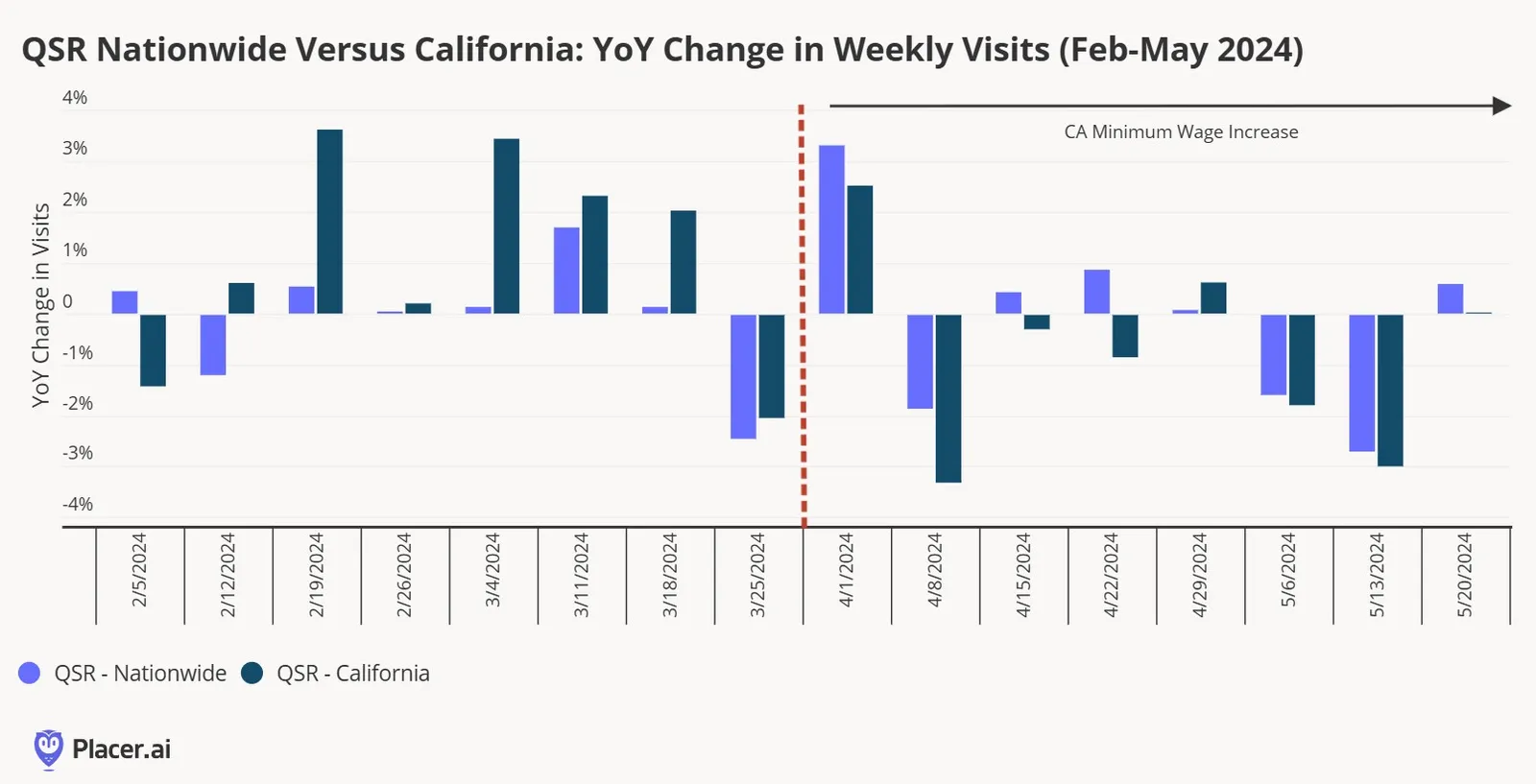

- Traffic to QSR chains in California has fallen modestly since a $20 minimum wage for fast food chains with over 60 units went into effect April 1, according to a report by Placer.ai.

- From January to March, these chains were seeing positive traffic trends in the state. That trend reversed during the eight weeks following April 1, with traffic falling by 1% to 3% year-over-year during that period.

- Chains, including McDonald’s, Jack in the Box, Shake Shack and Chipotle, raised prices in the mid-single digits to mid-teens to compensate for the labor cost increase beginning late last year.

Dive Insight:

McDonald’s is among the chains that has seen a significant shift in its foot traffic in California, according to Placer.ai. The chain’s stores in the state performed at or above the nationwide average for traffic prior to April 1, but traffic slid into negative territory, lagging national traffic by about 2.5%, in the eight weeks of April/May.

“Our data indicates that QSR burger chains have generally been the hardest hit by the California increase in minimum wage and subsequent increase in menu prices,” wrote R.J. Hottovy, head of analytical research at Placer.ai. “In addition to McDonald’s, we see that other large QSR burger chains in the state also underperformed their national average following the minimum wage increase.”

The chains hit hardest include Burger King, which saw foot traffic in the state fall behind its national averages by nearly 4% during April/May compared to an overperformance of nearly 0.5% in February/March. Wendy’s also lagged its national averages by over 3% in April/May after its California stores had traffic roughly 2% higher than elsewhere in February/March, per Placer.ai.

Regional QSRs like Rubio’s have also been hit hard. The chain declared bankruptcy on June 5, citing increases to the minimum wage in California as one of the reasons for its financial troubles. It also closed 53 restaurants as part of its restructuring plan.

On the other hand, several casual chains, which aren’t required to pay $20 an hour, are seeing improvements in traffic, according to Placer.ai. Its data shows that traffic at California Olive Gardens was up almost 2% YOY in April/May, compared to a 1% increased in February/March. Chili’s, which saw traffic decline 3.6% YOY in February/March, saw visitations turn positive in April/May by 0.2%.

Casual chains have been leaning heavily on value messaging. Chili’s has expanded its 3 for Me menu, which offers an appetizer, drink and entree for $10. Buffalo Wild Wings is offering an All-You-Can Eat Wings promotion for $20 on Monday and Wednesday until July 10. Visits at the chain increased by nearly 30% on May 13 and were up over 55% on May 27 when compared to average Monday visits at Buffalo Wild Wings from January to May 2024, Placer.ai data showed.

“After struggling with food and other inflation pressures the past two years, consumers are clearly in a deal-driven mindset,” Hottovy said in an emailed statement. “Buffalo Wild Wings' all-you-can-eat promotion on Mondays and Wednesdays in May was one of the most successful promotions in terms of driving increased visitations that we’ve seen in the casual-dining category in some time, and it wouldn’t be a surprise to see other chains introduce similar limited-time promotions in the near future.”

Traffic could shift back to many of the QSR chains, however, since brands like Burger King and McDonald’s are pursuing various value menu promotions this summer, including $5 value menu promotions. Jack in the Box rolled out a $4 Munchie Menu at the end of May.