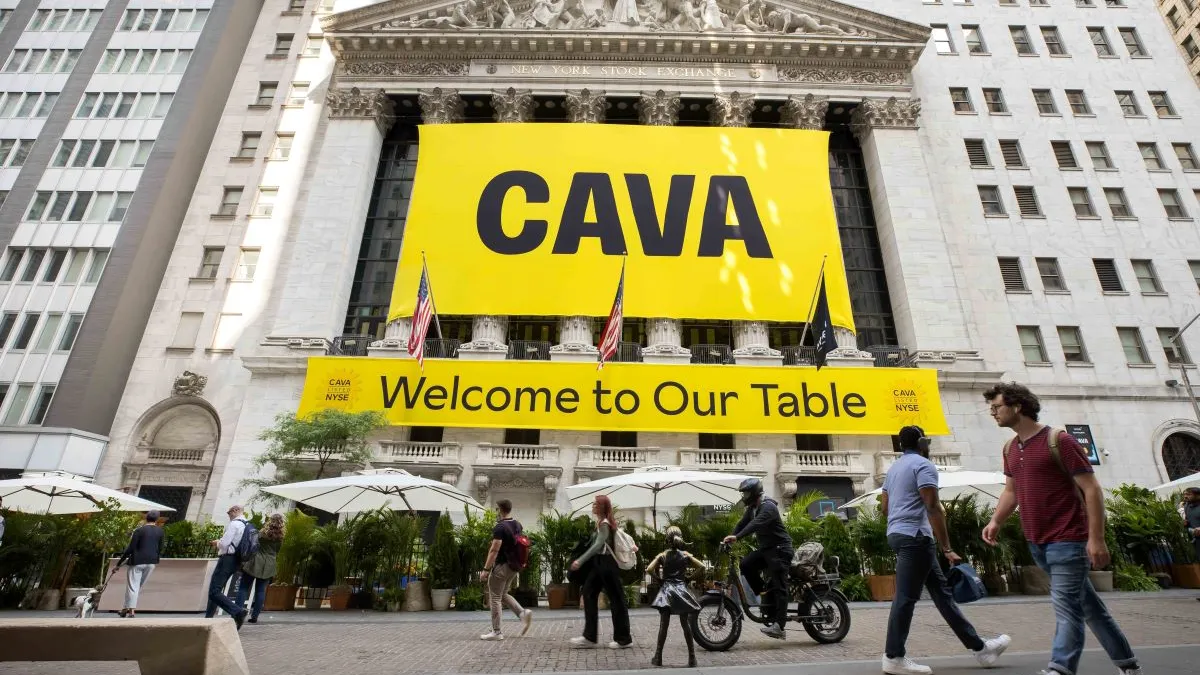

Cava debuted on the New York Stock Exchange Thursday, becoming the first major fast casual chain to go public since 2021. In the early hours of trading, the Mediterranean restaurant’s share prices climbed to $45 and closed at $43. This share price is nearly twice as high as its initial public offering at $22 per share, which raised about $318 million.

“It’s an exciting opportunity,” Cava CFO Tricia Tolivar told Restaurant Dive. “What we look forward to is the ability to take the Cava brand to many more cities across the country.”

Cava has ambitious goals as a public company, and plans to grow from over 260 units to 1,000 by 2032 with the funds raised from its IPO.

“We deliver high-unit level economics that we've proven out in many, many markets across the country,” Tolivar said. “And that leads us to understand now that we have an incredible whitespace opportunity with a strong, robust infrastructure to support that growth.”

Cava’s success could help persuade other restaurant brands to go public after a dry spell. Last year, no major chains went public due to rising interest rates and other negative economic conditions. With inflation slowing, and the Federal Reserve pausing interest rate hikes, the timing could be right for brands like Fogo de Chão and Panera Brands — which are rumored to be planning IPOS — to go public later this year.

Restaurant Dive spoke with Tolivar about Cava’s decision to go public, the company’s path toward profitability and its expected growth.

Editor’s Note: This article has been edited for grammar and brevity.

RESTAURANT DIVE: What made Cava decide to go public?

TRICIA TOLIVAR: We feel very well positioned to be successful. We've always been focused on being the best Cava we can be, whether public or private. That meant making sure we have the right team members, the right processes, and the right investments to be able to do that. We really want to be able to bring Cava to more and more people. We get requests all the time from our guests who’d love to invest, and certainly Cava presents that opportunity in the public market. We also are a consumer brand. So the awareness around being a public company is also helpful in that regard. Then also solidifying our strong balance sheet with additional capital is another component of it. That gives us additional flexibility as we continue to move forward on our growth trajectory.

Where are you on your path toward profitability?

Our unit economics are incredibly strong. Our restaurant-level profit margins are impressive and growing. And so with the growth that we have and the embedded infrastructure investments that we made, we believe that those investments should pay off over time. And those include investments in many different areas, whether it was our real estate, design and construction teams, people and technology to support that, our technology investments around digital, or investments in people on the operation side, to ensure we've got the right platform to grow successfully. That's really put us in a great position to handle the significant growth we've had in the last few years, as well as the growth that we anticipate in the future.

What investments did you make in real estate, construction and digital channels?

In early 2021, we had a successful fundraising event where we raised $190 million. And we leaned into a number of areas to ensure that we had the right platform and foundation for growth in the near term and in the longer term.

From a real estate design and construction standpoint, we expanded the number of team members we had. We enhanced our technology and tools and processes to ensure we had great decision making and a robust pipeline of restaurants for growth to execute against the target of at least 1,000 restaurants by 2032.

From a digital standpoint, we made a number of investments. So to make sure that our platform was scalable, we shifted from a monolithic environment to a microservices environment.

And that allows us to handle increases in growth, improve speed, and then additional investments around improving the enhancements and the features of our apps and on the web, such that it will increase conversion and improve the experience overall for our guests. A monolithic structure is one that has difficulty in scaling, because as you get bigger, they're all interconnected. A microservices environment is one where each component, so loyalty or pricing, for example, are in different sections. You can scale and add and enhance without having to unwind everything that's been done prior.

How do you see going public as helping accelerate your growth as you work to reach your unit count goal?

Our balance sheet prior to the capital raise was very clean; there's no debt outstanding. We have access to a $75 million revolver and a $25 million accordion as well as a $30 million direct-delayed draw term loan to support the cost of the build out of our manufacturing facility, which is opening in the beginning of 2024. And all of that gave us ample opportunity to be able to execute against those growth plans.

What the fundraise allows us to do is further strengthen an already strong balance sheet and create additional flexibility in the event that perhaps a recession that we've been long anticipating presents itself, we might be able to be more opportunistic as we were during the pandemic as it relates to growth.

How does the fundraise allow you to expand into new markets and different demographics?

Our intention is to be in about 90% suburban markets as we look at our pipeline in the future. And what we're finding is that we're very successful in a number of different environments. Whether it's in Back Bay in Boston, or Birmingham, Alabama, throughout the country we've found success in many different geographies and formats. So with very strong AUVs, we're able to take the brand and replicate it in many, many more markets, whether they're existing markets or new markets we've yet to explore.

How do you see your digital drive-thru pickup playing into your growth plans?

We certainly believe digital drive-thru pickup lanes are an opportunity for us to lean into. And so what we do is we evaluate each and every real estate site and determine what's best for the guests, and what drives the highest overall returns.

What most often we evaluate is the overall cost of the location, and making sure that we're making the right decision, and investing in the right piece of real estate to drive a meaningful return. And for the guests themselves, the pickup lanes work better in a suburban environment. You can see in the markets themselves how other pickup lanes are delivering, and we'll evaluate those and determine what's best in the future.

What does this successful first day of trading tell you or hint to where Cava is headed?

What we're looking at is the long term. That’s what matters to us. We're very focused on our strategic plans and delivering on our financial goals and objectives and taking care of our people and making sure that they continue to drive our mission of bringing heart, health and humanity to food and doing that in a very meaningful way. We believe Cava is the category defining leader in the Mediterranean space, which has tremendous growth opportunities.