Dive Brief:

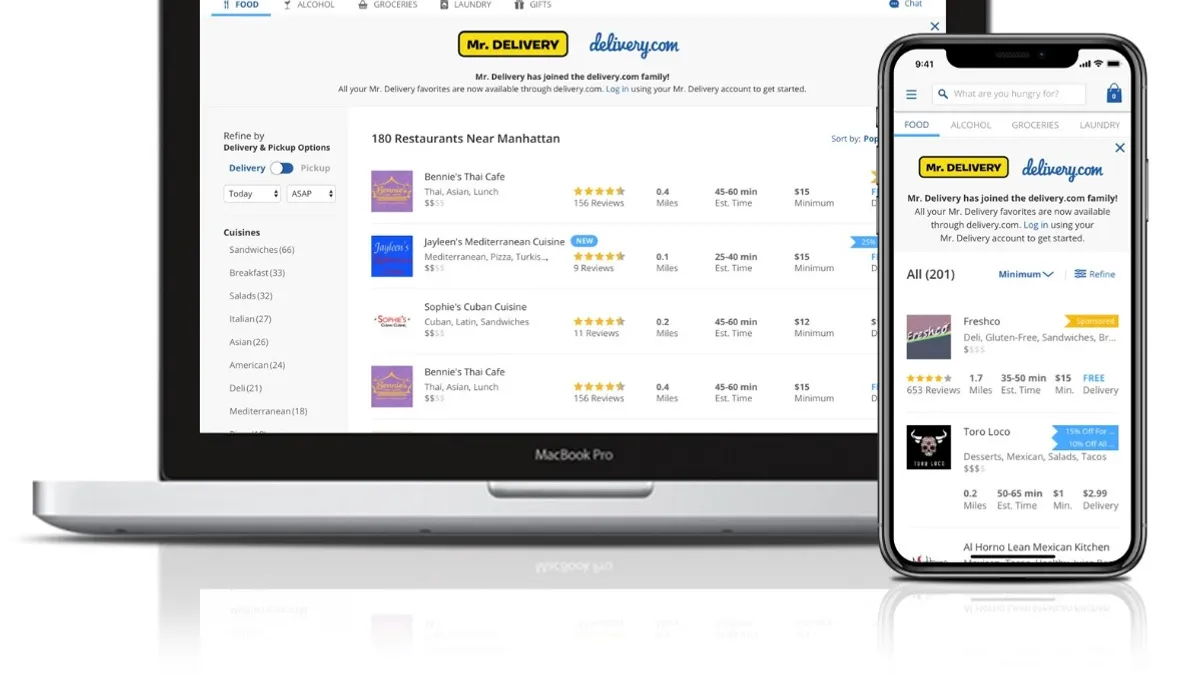

- Delivery.com will expand its reach and food delivery capabilities with its acquisition of Mr. Delivery, expanding into 38 states and reaching over 1,800 U.S. cities, according to a press release emailed to Restaurant Dive.

- The acquisition is part of delivery.com's strategy to expand its operations into Mr. Delivery's current footprint of 160 cities, with more companies coming online in the next few months. Both companies focus on independent and local operators.

- Mr. Delivery restaurant owners and drivers will gain access to delivery.com's dispatching capabilities to fulfill orders as well as the company's confirmation tools, real-time business analytics, group ordering and other corporate features and partner integrations. Mr. Delivery market operators will continue to grow their established networks of local restaurants, merchants and drivers while delivery.com will gain last-mile delivery capabilities with access to Mr. Delivery's driver network.

Dive Insight:

Consolidation, especially among small to midsize delivery operators, is expected in a very crowded U.S. food delivery market. Delivery providers, especially those that focus on independent operators, will either have to grow their footprints within existing or new territories or through acquisitions in order to survive as bigwigs DoorDash, Uber Eats and Grubhub grab more market share.

Delivery.com has been expanding its visibility of late, partnering with Google in May to add delivery on Google Search, Google Maps and Google Assistant. Caviar made a similar move with a partnership with OpenTable, where users can search for restaurants and order delivery through Caviar as well as UberEats and Grubhub instead of booking a table.

But acquisitions have been the quickest ways for companies to grow, especially since the acquirer gains an already viable book of business and the local expertise within those markets. Waitr expanded to 500 cities after buying Bite Squad last year, while Caviar was bought by Square in 2014. Grubhub has also been actively acquiring companies, most recently LevelUp and Tapingo.

As large providers consolidate and expand while smaller providers also do so but maintain their focus on independent operators, the future of delivery could also become much more split between companies focused solely on larger chains and enterprise relationships and ones more focused on independent restaurant operators.

Restaurants have been moving toward multiple third-party delivery partnerships of late instead of exclusive partnerships to try to reach new customers and grow off-premise sales. Expanding delivery.com's footprint could make it more appealing to additional restaurant operators.

Delivery.com will provide its full services to Mr. Delivery markets and expand offerings beyond food delivery, delivery.com CEO Jed Kleckner told Restaurant Dive in an email.

"As part of our strategic growth plan, we are expanding the reach and capabilities of our on-demand ordering platform and looking at ways to scale the business efficiently," Kleckner said. "We are actively considering acquisition opportunities where it makes strategic sense to expand to new markets or to expand our verticals or delivery services."

He said now is a good time to expand because consumers using online ordering and delivery services are emerging in markets outside large metros and the demographic is broadening. Ride-sharing has primed people to use their smartphones for more than just communication, but for transactions as well, he said. Brands, especially in fast casual and quick service are turning to online ordering for an incremental growth opportunity, Kleckner added.

"As the needs and expectations of brands and consumers have shifted, there is real demand for online ordering and delivery services that we are capitalizing on by expanding our business," he said.