Dive Brief:

- Domino’s U.S. carryout business increased same-store sales by 19.6% in Q3 2022 compared to the year-ago period, CFO Sandeep Reddy said Thursday during the company’s earnings call. Compared to Q3 2019, comparable carryout sales were up 35%.

- Carryout sales grew 14.6% year-over-year during Domino’s second quarter, and 33% on a three-year basis.

- The pizza chain’s same-store sales are likely to jump in Q4, as the company plans to increase prices for its carryout Mix & Match Deal menu from $5.99 per item to $6.99 per item on Oct. 17.

Dive Insight:

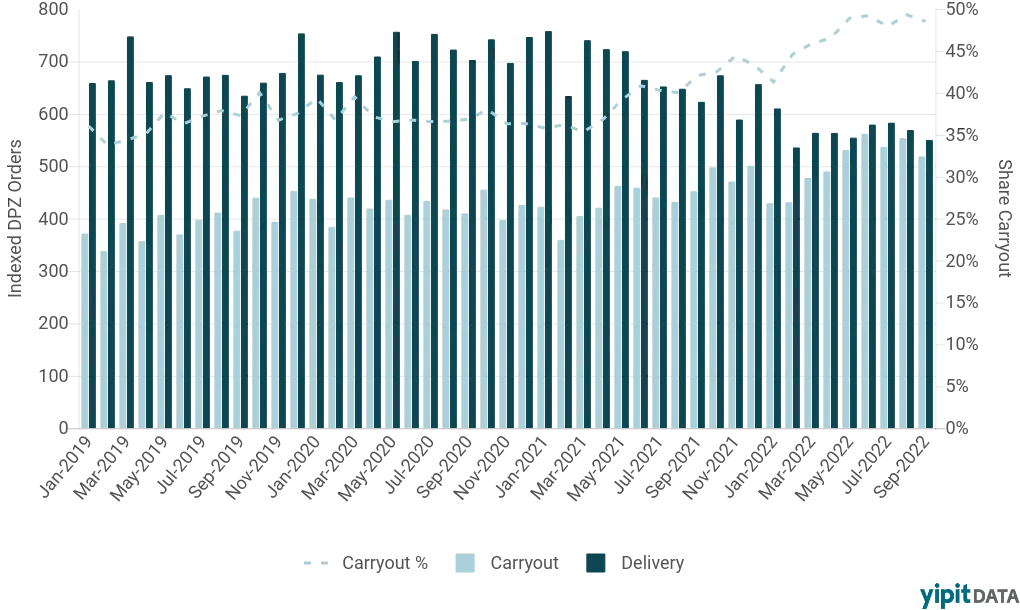

Carryout at Domino’s continues to outperform delivery in the fourth quarter to date, but gross food sales did slow while delivery accelerated in September, according to YipitData research, which specifically tracks digital sales, emailed to Restaurant Dive. Carryout made up about 49% of orders, the data shows.

While staffing continues to be a headwind for the chain, the gap in carryout sales between the top 20% and bottom 20% performing stores is relatively small due to strong consumer demand and the channel’s lower cost compared to delivery service, Reddy said.

Domino’s U.S. same-store sales increased 2% during the third quarter, an improvement compared to the 2.9% decline reported during Q2 2022. This positive change is largely due to ticket growth, which included pricing increases of 5%, partially offset by order declines, Reddy said.

In March, Domino’s raised the price of its delivery Mix & Match Deal menu — which had let diners pick two or more select items $5.99 each — to $6.99, but still maintained its relative value, Domino’s CEO Russell Weiner said. Over the last six months, Domino’s examined how competitive pricing evolved in the marketplace alongside increased food costs and determined that now was the best time to raise carryout pricing to improve profitability for both franchisees and the company, Reddy said.

Domino’s isn’t concerned about customers seeking carryout elsewhere, claiming it's the top carryout pizza QSR in the U.S., Weiner said.

“Our role within this inflationary environment is to be a strong relative value in QSR for our customers,” Weiner said.

Domino's delivery versus carryout sales

Delivery, on the other hand, could be more impacted by inflation due to additional fees and tipping that come with this channel, Weiner said.

“Our research shows that a relatively higher delivery cost might lead some customers to prepare meals at home,” Weiner said. “This could be exacerbated as consumer spending becomes more constrained around the holiday.”

In the meantime, Domino’s delivery channel has shown signs of improvement, especially as staffing levels have increased across its system to meet ongoing demand. U.S. delivery same-store sales decreased 7.5% compared to Q3 2021, but were up 8.4% compared to Q3 2019, Reddy said.

In previous calls, Domino’s executives said they would look into improving driver flexibility, expand store operating hours and deploy a call center to help with phone orders. The phone system is now available in about half of its U.S. stores to help answer some calls, Weiner said.

The gap in delivery sales between top-performing stores and bottom-performing stores decreased to 8%, compared to 11% in the second quarter and 17% in the first quarter, Reddy said.

Correction: A previous version of this article misidentified the type of data in the YipitData chart. The data represents digital orders tracked by YipitData.