Dive Brief:

- Grubhub will add three new features to Direct, the commission-free branded ordering channel for independents it released in 2021, within the next few weeks, the company announced Thursday.

- Direct will soon have an integration with Google Business profiles, provide $0 delivery fees per order (previously $1.99) and allow customers who don’t have Grubhub accounts to use a guest checkout.

- These features were created in response to feedback from its restaurant leadership council, in-person interviews, site visits and surveys, said Kate Green, VP of restaurant services and innovation.

Dive Insight:

Grubhub has learned about industrywide challenges around resourcing and timing for operators, Green said. The company is looking for ways to create automation whenever possible to ease these challenges for partner restaurants, she said.

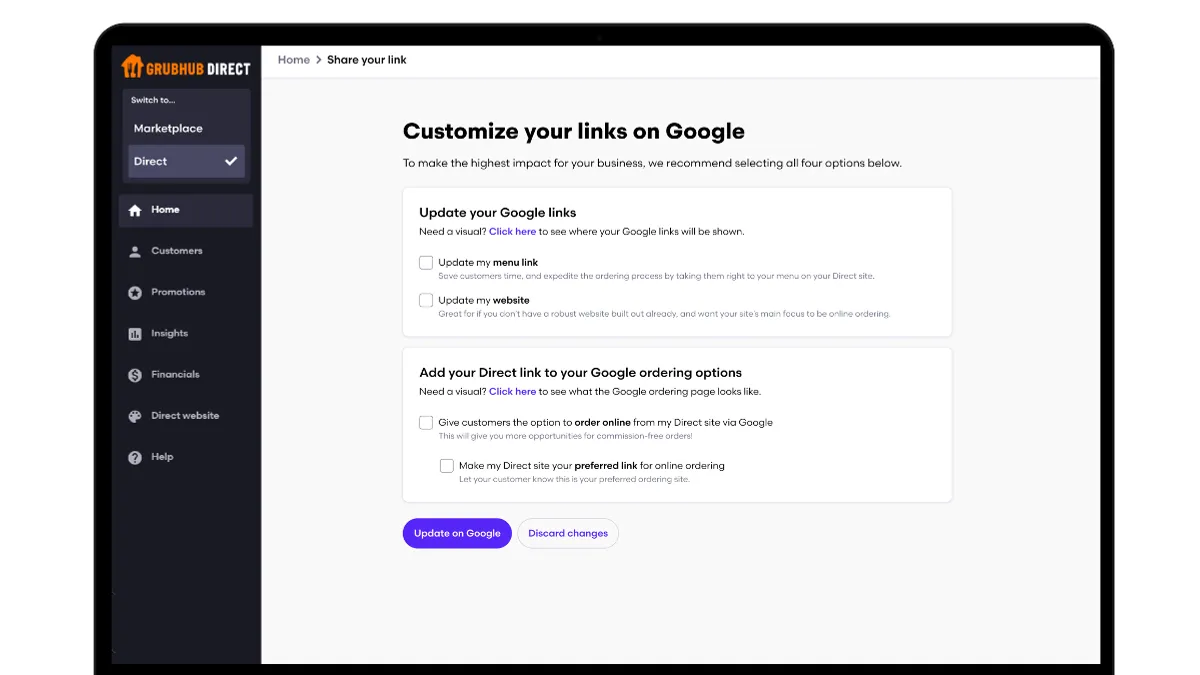

The integration with Google will allow restaurants to add their Direct sites to their business profiles on Google Search and Maps and to highlight it as their preferred ordering channel, the company said. Merchants can select this option through the Direct dashboard. During testing, Grubhub found that Direct merchants that used this integration received roughly 20 times the amount of orders compared to Direct merchants who didn’t include their Direct sites on Google.

“Branded channels are all about discoverability,” Green said. “So the more that you promote your link, the more you’re going to be discovered and the more orders you’re going to generate.”

While Direct has not charged marketing commissions, it still charged $1.99 in delivery fees per order. The new upgrade will remove that fee, the company said.

“We want merchants to be able to fulfill any order that comes through their channels without worrying about the cost associated to do so,” Green said.

Grubhub has also created a guest checkout feature that will allow diners to order from a merchant’s Direct site without creating a Grubhub account.

“Our thinking here was trying to remove a barrier for a diner wanting to place an order at checkout,” Green said. “So it was really making sure that we can facilitate that order generation to meet any diner’s needs and still create that value for the restaurant.”

Grubhub said it will continue to test additional branded channels to help merchants create more touchpoints with customers. For example, the company has seen the value of enterprise-based branded mobile channels and is exploring ways to scale that solution to meet the needs of SMB merchants, Green said.

Grubhub Direct currently gives merchants access to diner data within the dashboard, providing the opportunity to use that data in campaigns and loyalty programs, Green said.

“We want to make sure the merchants have the ability to attract, to engage and to retain as many diners as possible,” Green said.

Competitors have also been enhancing products targeted at independent restaurants and creating easier access to their platforms within the last year. DoorDash revamped its product offerings for small- and medium-sized restaurants with expanded diner insights and educational resources last year. Its Merchant Product allows restaurants to choose the services that best fit with their needs. Uber Eats partnered with Toast and Clover in the U.S. and Canada to allow restaurants to join Uber Eats through the POS providers.