Dive Brief:

- Tillster Delivery Index, which surveyed 2,000 QSR and fast casual customers, found that more than 51% of consumers said they would order more often if delivery was offered.

- In the past 12 months, more than 50% of QSR and fast casual customers ordered online delivery. That same number of people order for delivery between one and five times a month.

- More than 30% of customers most want to see delivery features on restaurant apps, per the report.

Dive Insight:

This index underscores just how in-demand delivery really is for consumers, and any restaurant chains waiting to see how the delivery space plays out will be left behind sooner than later. Plenty of other research supports Tillster’s research, too. Between 2013 an 2018, delivery visits rose 10% and sales jumped 20%, according to The NPD Group. Morgan Stanley predicts that delivery could account for up to 40% of industry sales within the next few years.

Younger consumer seeking convenience are driving this trend, which means it has significant staying power. According to a recent report from investment bank UBS, millennials are three times as likely to order delivery than their parents. Ninety percent of millennial parents order takeout at least once a week, according to Technomic's 2017 Millennial Parents Insights report. Further, about three-quarters of millennials without kids follow the same patterns.

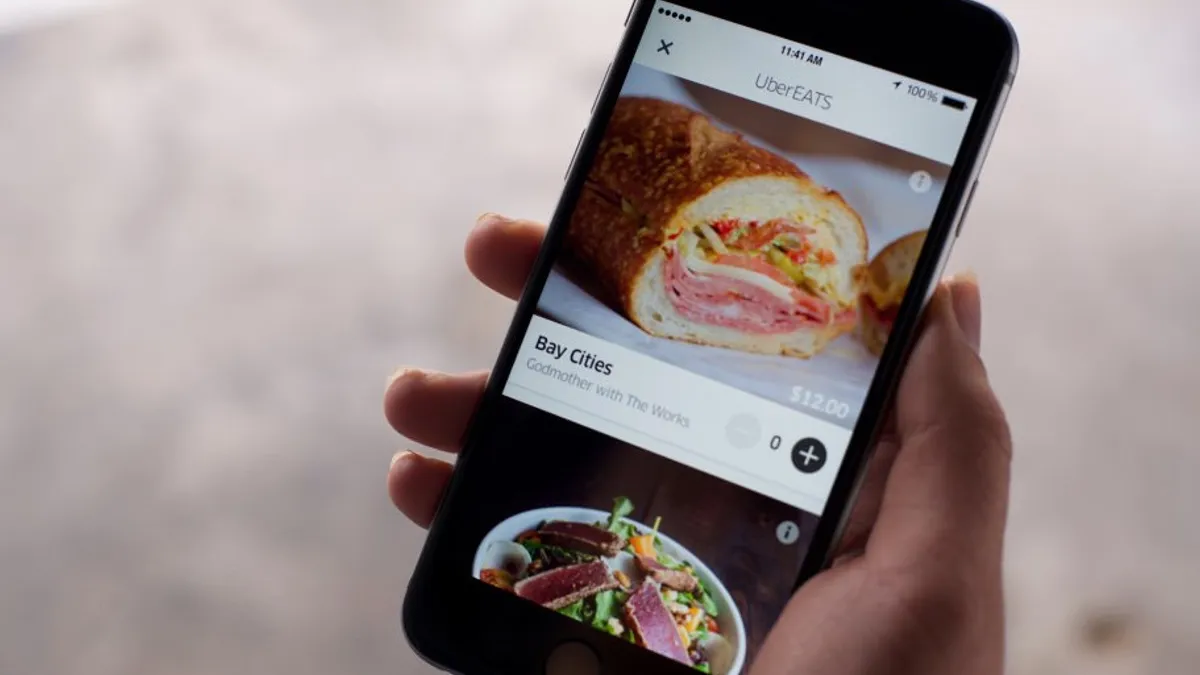

What is perhaps most interesting about the Tillster research, however, is that these consumers prefer to order directly from a restaurant versus one of the many third-party aggregates in the growing space. Fifty percent of customers prefer to order directly from a restaurant website or app, compared to just 6% of fast casual and 3% of QSR customers who prefer to order directly from a third party like DoorDash, Grubhub, UberEats or Postmates. This is despite the fact that these third-party companies are securing massive amounts of funding and using some of that funding for marketing purposes.

But while these delivery companies throw money behind marketing campaigns, restaurant giants themselves are shifting their marketing focus a bit to raise awareness of their delivery services. McDonald’s, for example, just partnered with La-Z-Boy for a sweepstakes created specifically to promote its Uber Eats partnership. CFO Kevin Ozan told the JP Morgan Gaming, Lodging, Restaurant and Leisure Forum crowd that McDonald’s will be focused on growing awareness of its delivery offering through advertising this year, after spending two years focused on rolling out the service. It will be hard for delivery companies to make up ground if more restaurant brands are throwing their marketing weight behind off-premise initiatives.

But that doesn’t mean restaurants have much room to get complacent. Third-party apps might not be the instinctual delivery choice for consumers yet, but these delivery companies are innovating, expanding quickly and, in some instances, even changing the marketplace. Restaurants are also wise to push their delivery presence, as consumers who instead order on a third-party app will be exposed to an entire marketplace that could sway their craving to another restaurant.