Prices have been climbing on restaurant menu boards for much of the year to offset spikes in food and labor costs, but that doesn’t mean diners are used to the strain on their wallets.

As a result, major restaurant chains are walking a tightrope — charge enough to protect the bottom line without alienating customers and ceding traffic to competitors or grocers.

Input cost inflation ran well ahead of menu pricing, Paul Westra, managing director of restaurants investment research at Capital One, said. Average menu price hikes are around 6% over the last 18 months, but restaurants need to aim for an 11% increase to protect profits, he said. This discrepancy has impacted store-level profitability with profit declines of over 20%, which echo drops seen during the Great Recession in 2008, Westra said.

“The good news is the consumer held up relatively well and is continuing to hold up relatively well,” Westra said. “And the great news is we’re seeing inflation largely normalize.”

The general consensus on Wall Street is that most, if not all, of the margin and profit losses restaurants have seen in the last 12 to 18 months will be recovered, Westra said, adding that most predict a near 20% increase in restaurant profitability over the next 12 to 18 months. But menu pricing is going to come down at a slower pace than cost inflation, he said. If that dynamic continues into a consumer recessionary period, it could be a risk.

Matt Goodman, senior equity research analyst at M Science, echoed this concern.

“On one hand, food-at-home pricing is rising more quickly than food-away-from-home, increasing the relative value of the restaurant-driven meal,” he wrote in an email to Restaurant Dive. “That said, if the consumer budget is further stretched, the absolute cost of grocery-driven meals is still generally lower (all else equal) than a meal from a restaurant, even a value-driven QSR like McDonald’s.”

This dynamic could limit the ability of QSRs to attract diners in great numbers, he said. The fast casual category is also at risk.

“Since gas prices have drifted lower, we have seen some dollar share flow back towards more-expensive dining categories. Nonetheless, we think if Fast Casual (including Chipotle) gets too aggressive on price … a potential loss of customers to Quick Service is certainly possible,” Goodman said.

Ultimately, however, restaurants across categories are still benefiting from strong diner demand. M Science data shows QSR chains have seen the highest average check increases this year compared to 2019 at 27% compared to fast casual (26%) and casual (23% to 24%), he said.

To learn how major chains are approaching menu pricing strategy, Restaurant Dive examined comments from Chipotle, Domino’s, McDonald’s, Shake Shack, Starbucks and Wendy’s during their latest earnings call.

Chipotle

In October, Chipotle raised menu prices between 2% and 3% in roughly 700 restaurants to “address pockets of outsized wage inflation,” Chipotle CFO Jack Hartung said during the chain’s Q3 earnings call. Overall, this translated to a companywide impact of 0.5%

“The benefit of menu price increases offset elevated costs across the board, most notably in dairy, packaging and tortillas. In Q4, we expect our cost of sales to remain at about the same level, as the benefit from the menu price increases will be offset by higher beef, chicken, dairy and tortillas,” Hartung said.

Compared to Q3 2020, Chipotle’s menu prices are up over 20%, CEO Brian Niccol said on the call. But he claims the Mexican chain’s prices are still between 10% and 30% lower than what Chipotle’s competitors charge. Consumer sentiment hasn’t been negatively affected either, he said.

“When you look into the business, we're not seeing people all of a sudden not buying guacamole or also changing what they typically add to their order or switching between proteins. Things have stayed pretty consistent,” Niccol said.

For Q4, Chipotle expects leverage from increased menu prices to help ease labor costs.

Domino’s

The average price increase across the pizza chain’s U.S. system was 5.4% during the third quarter, Domino’s CFO Sandeep Reddy said during the chain’s Q3 earnings call. The company expects price hikes to reach about 7% in Q4, a bump resulting from increasing the chain’s carryout Mix & Match deal from $5.99 to $6.99 on Oct. 17.

“The delivery fees and the menu prices are both franchisees' decision on what they make,” Domino’s CEO Russell Weiner. “What we do there, though, is we provide them with what the competitive context is at a local level.”

Domino’s menu pricing strategy hinges on relative QSR value regardless of inflationary pressure and food cost changes, Weiner said.

“The philosophy on how we look at pricing in the company… [has] been happening over the last decade or more,” he said. “We would look at our input costs and essentially what that does in terms of long-term store profitability for the franchisees and our own corporate stores. But then we also look at the relative consumer price points and competition in the market.”

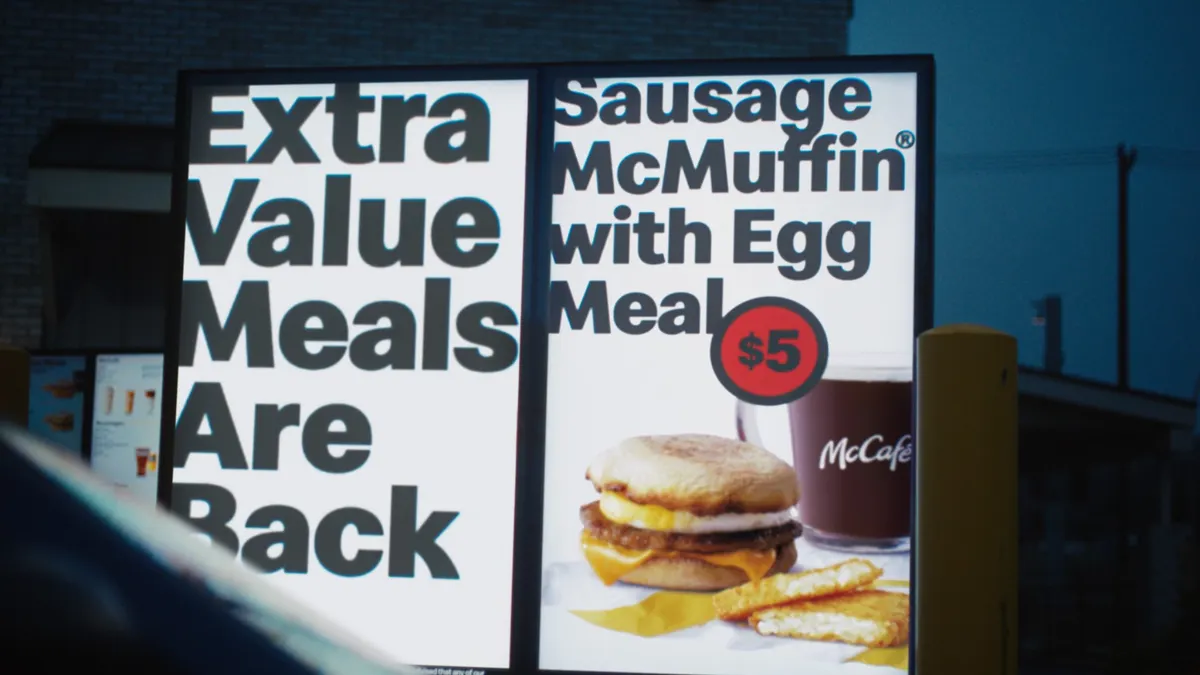

McDonald’s

The burger giant reported an average U.S. price hike of roughly 10% year-over-year for the third quarter.

Despite this increase, McDonald’s hasn’t seen “significant trade down” between its menu items, CEO Chris Kempczinski said during the chain’s Q3 investor call. The company is, however, reaping the benefits of some diners choosing to buy from fast food chains rather than pricier restaurant categories as discretionary spending budgets become slimmer.

The company is confident in its near-term performance despite expected economic challenges, including a predicted “mild to moderate recession in the U.S.” next year, Kempczinski said.

McDonald’s will overcome these obstacles through increased interest from low-income diners and its value-oriented digital and delivery offerings – even without its Dollar Menu, which helped the company weather the Great Recession in 2008 and 2009, Kempczinski said.

Shake Shack

Shake Shack boosted its menu prices between 2% and 10% across price tiers in October to offset inflation, and the company expects to maintain a high single-digit price increase in 2023. Previously, the chain hiked its menu prices by 3.5% in March, CFO Katie Fogertey said during the chain’s Q3 earnings call.

“Even with this price increase, a Shackburger, fries and beverage is on average under $14, well within and often priced below the cost of other lunch or dinner options nearby. Our value perception among guests remains unchanged, and we continue to see strong demand for our premium LTOs,” Fogertey said.

This menu price bump, coupled with traffic growth at Shake Shack’s urban stores, contributed to a same-store sales increase of 8.3% year-over-year in October 2022.

“This fourth quarter we will have the benefit of nearly a full quarter of new menu pricing to help address some inflationary pressures we are facing. We are planning for high single-digit inflation in food and paper costs through the rest of the year, led by continued high inflation in dairy, accelerating cost pressures in fryer oil, fries and ketchup and low double-digit inflation in paper and packaging,” Fogertey said.

Shake Shack customers are also trading up and adjusting back to pre-pandemic spending habits, she said.

“We're seeing people add on more to their check. We're seeing great strength in cold beverage. All these things leave us encouraged that our guests really [do] value our elevated premium and differentiated approach to menu innovation,” Fogertey said.

Starbucks

Starbucks has raised prices about 6% over the past year, but the coffee giant hasn’t seen diner interest recede, interim CEO Howard Schultz said during the chain’s Q4 earnings call.

“Their loyalty to Starbucks has been quite significant and predictable,” Schultz said. Still, he added the company is “certainly not going to try and raise prices during this time.”

The company’s customization is driving accretive ticket growth despite higher prices, Schultz said.

“In North America overall, the combination of customer shifts toward premium hot and cold beverages, increased customization, strategic decisions around beverage, food and modifier pricing and an 18% increase in food sales drove net revenues up 15% year-over-year to a record $6.1 billion,” he said.

Wendy’s

The burger chain’s U.S. prices rose slightly less than 10%, Wendy’s CEO Todd Penegor said during the chain’s Q3 earnings call.

The company is confident, however, that it won’t be threatened by competitor value.

“As far as competitive pressure is concerned, as I look at NPD Crest data, the deal levels that are happening in the category are not elevated versus what we have seen previously,” CFO Gunther Plosch said on the call. “So we're not seeing any strong signs that there are kind of big value wars to come.”

Still, Wendy’s is using third-party pricing specialists to guide its strategy — and franchisee strategy — and is tweaking its analytics and marketing to push more diners to trade up, Plosch said.

“At the end of the day, the proof is in the pudding, right? We have yet again in this quarter held our dollar and traffic share in the category,” Plosch said.

Penegor believes Wendy’s current stability will hold in the near term.

“The healthier consumers will continue to come out. We’ll start to see those frequency gains and get folks from food at home to food away from home,” Penegor said