Between supply chain constraints, wage growth and increased operating costs, restaurants continue to face major challenges even in an environment where COVID-19 is endemic. With dine-in sales largely reaching 2019 levels, restaurants are benefiting from high demand, but many lack adequate staffing to meet that traffic. Chains like Domino’s are struggling to gain enough workers to keep up with consumers, while Papa Johns has been supplementing its workforce with third-party delivery drivers. Outsourcing labor has helped some chains manage, but overall costs just keep going up.

To protect their bottom lines, many chains are passing the bulk of those costs onto consumers. Menu prices have increased over the last few months, but the overall jump is lower than food-at-home prices, according to the Consumer Price Index. Food-at-home prices were up 13% in September year-over-year compared to an 8.5% increase for food away from home. Full-service menu prices rose 8.8% while limited-service menu prices jumped 7.1% in September year-over-year.

Restaurants are also increasingly pessimistic about economic conditions over the next six months. Forty-three percent of operators surveyed by the National Restaurant Association in September expect worsening conditions, compared to 8% expecting better conditions in the next six months. With the Federal Reserve increasing interest rates to combat inflation, many restaurants and analysts believe a recession is around the corner. This could prove beneficial for operators seeking much-needed labor, as recessions can drive up unemployment rates and push more people into foodservice jobs. At the same time, a recession could make consumers even more cost-conscious, and unable to afford eating out as much as they did previously.

Hiring remains difficult, and some operators are pulling back due to cost

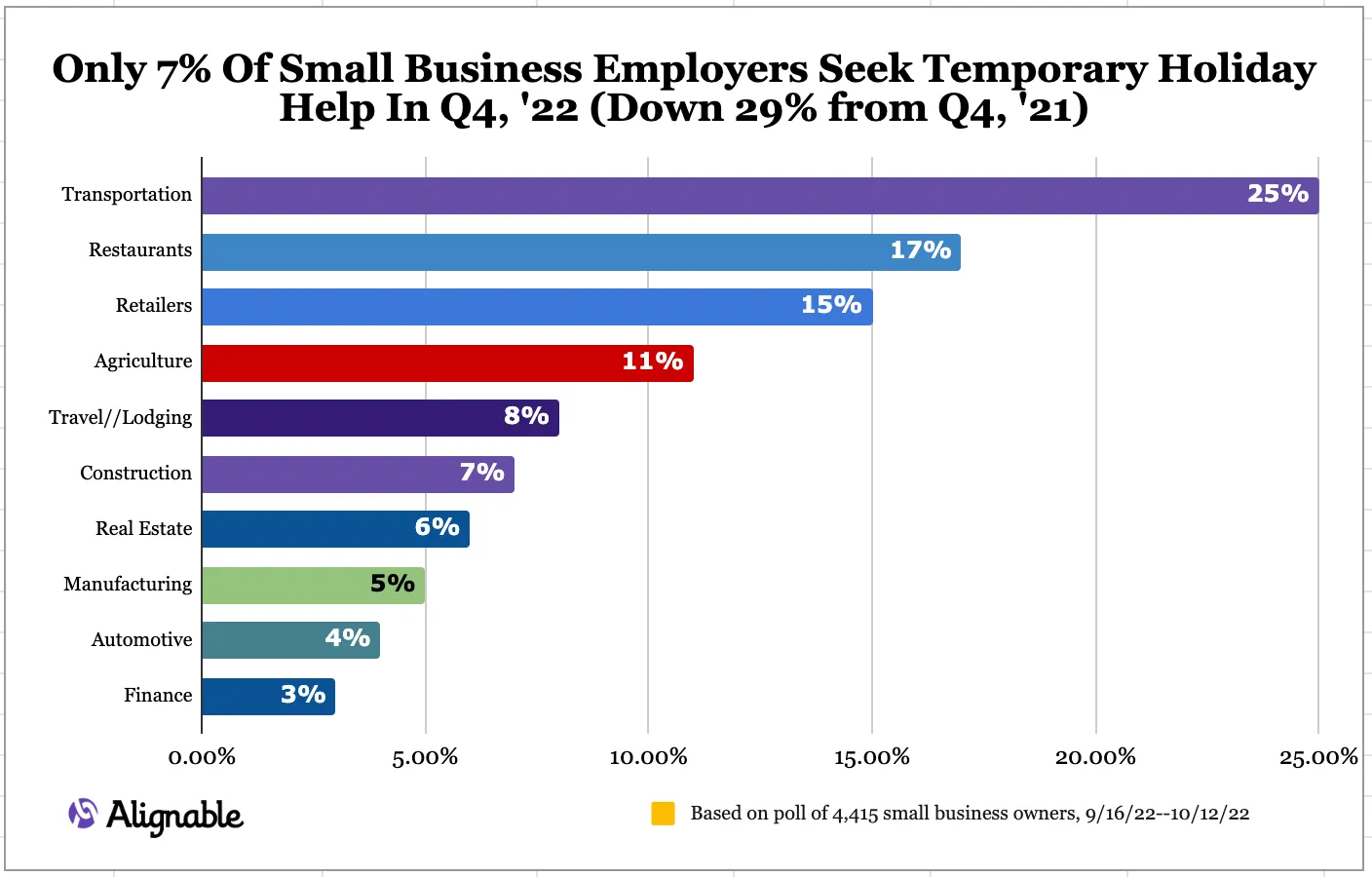

Inflationary conditions have created a mixed bag within the restaurant labor market. Despite the industry lacking 500,000 workers compared to pre-pandemic levels, some operators are scaling down their hiring plans, even as they head into the busy holiday season. Compared to the beginning of Q4 2021, when 56% of restaurant operators planned to staff up significantly, only 39% said they planned to do so at the start of Q4 2022, according to an October report from Alignable.

Forty-eight percent of operators aren’t hiring seasonal or permanent employees, and another 8% are laying off employees because revenues no longer support additional hires, according to Alignable.

Hourly earnings continue to rise month-over-month for non-supervisory foodservice workers, surpassing $17 per hour in August, according to the U.S. Bureau of Labor Statistics. Prior to the pandemic, hourly wages were $14.17 in February 2020.

Restaurants that can afford to hire still face obstacles, with one in three restaurants reporting they have had a difficult time attracting new staff members during 2022, according to a Toast report.

The good news is that the industry is about 95% employed versus pre-COVID-19 levels, Paul Westra, managing director of restaurant investment research at Capital One, said, referencing BLS data.

“Labor is much more in balance than it has ever been,” Westra said. “From a labor rate perspective, labor rate inflation since May has been running only about 4%. Both from a cost of goods sold and a labor perspective … the worst is certainly behind the industry.”

Turnover is still high, with a churn rate about 20% above pre-COVID-19 levels, Westra said.

“There’s still a lot of turnover, but I’d say the number of open positions has begun to come down,” Westra said.

Restaurants combat inflation with menu price hikes

Ninety-one percent of restaurants surveyed by Rewards Network said they have raised their prices since the pandemic, but reported that a majority of customers have understood and haven’t complained. However, restaurants expect about 20% of their diners to cut spending because of inflation, according to Rewards Network’s survey of 1,000 restaurants during the summer. Coffee saw the highest price menu growth at 12% in July year-over-year, according to YipitData information emailed to Restaurant Dive. Pizza prices were up 11% while fast casual menu prices rose 9% year over year.

Chipotle increased menu prices by 4% in August on top of a 10% increase seen in 2021. McDonald’s hiked prices by 8% during the first quarter of 2022. In October, Domino’s increased its carryout Mix & Match menu, which allows customers to pick two or more items for a set price, from $5.99 to $6.99 per item, months after it did the same for its delivery Mix & Match menu.

Operators who were staying on top of supply chain cost increases started to adjust menu prices in the fall of 2020, Melina Patterson, VP at Patterson & Company Certified Public Accountants, said. Now, even with headlines reporting inflation has leveled off, menu prices are continuing to climb, she said. In some cases, independent restaurants delayed menu price hikes for as long as possible because of the additional work this entails, such as reprinting materials and making website changes, Patterson, who works with a variety of operators, added. Because of the ongoing labor shortage, many owners have to make these changes themselves due to a lack of staffing.

The combination of labor and product shortages have forced some operators Patterson works with to close some days of the week. Restaurants have cut operating hours by 6.4 hours per week — the reduction climbs to 7.5 weekly hours for independents — compared to pre-pandemic, according to a Datassenial report. Almost 60% of the 763,000-plus restaurants in the U.S. have operating hours in October that are shorter than they were 2019, CNBC reports.

While fewer operating hours hasn’t helped boost revenue, this move has allowed operators to be more efficient on the days that they are open, she said.

“A lot of our [restaurant clients] are really busy in spite of the fact that they’ve had menu price increases, and they have not in every case been able to react to the volume that they have,” Patterson said.

Sales are up, but diner traffic is down

With menu prices rising, same-store sales have generally gone up as well. Black Box Intelligence calculated restaurant same-store sales growth of 5.3% year-over-year, the strongest uptick since March, in its Q3 State of Restaurant Sales and Traffic report.

Industrywide sales grew to $87.2 billion in September — the highest ever since January 2021, according to a National Restaurant Association analysis. But when adjusted for inflation, sales during the third quarter were actually $1 billion less than the previous quarter.

Traffic reveals a different story. During August, traffic was down 1.9%, though this is an improvement over July’s year-over-year decline of 5.1%, according to the Black Box Intelligence report. August was the sixth consecutive month of year-over-year declines in guest counts. Chains that had the lowest check growth, however, posted the highest traffic gains — 16 percentage points higher compared to the quartile of companies that had the largest increase in average check, according to Black Box Intelligence.

Customers are trading down, skipping delivery

With menu prices rising, consumers are taking their spending to less-expensive, value-focused restaurants like QSRs, according to Black Box Intelligence. Restaurants told Rewards Network that they expect 20% of diners to seek more value from their dining expenditures.

The share of restaurant sales from low-income households (below $45,000) declined in July, while about 40% of sales came from high-income consumers (earning over $100,000), according to YipitData.

Consumers are increasingly searching for more affordable options, according to Yelp’s Q3 Economic Average report. Searches for budget dining and grocery options were up 11% in the third quarter compared to Q2 2022 and up 9% compared to the year-ago quarter. Searches for fast food and fast casual dining were up 10% compared to Q2 2022 and 8% compared to Q3 2021.

Visits to full-service restaurants were down 18.2% during the last week of September compared to the same week in 2019, and down 6% in 2021, according to Placer.ai data emailed to Restaurant Dive. Comparatively, QSR and fast food chains saw visits decline 7.1% that same week compared to 2019, but increase 0.7% compared to 2021. Brands that performed well during this time period include Texas Roadhouse, Chipotle, LongHorn Steakhouse, Waffle House, McDonald’s and Sonic. With the exception of McDonald’s, these brands reported double-digit traffic growth in Q3 compared to 2019.

With menu prices up, food delivery is a tougher sell for customers. Demand for food delivery is down, and fast casual third-party digital sales rose about 10% in July compared to a spike of 22% in July 2021, according to YipitData.

Off-premise dining is not as important as on-premise dining to restaurant operators, according to Toast’s survey. Forty-four percent of operators said on-premise dining will be of high importance to them over the next 12 months, compared to delivery (42%) and off-premise dining (41%).

What restaurants can do

Lean into loyalty: Rewards programs can provide diners with discounts, but only if they earn points through repeat business. Seventy-three percent of restaurants with a rewards program found these programs particularly important during this time, according to Rewards Network’s survey. Over the past year, just about every major chain — including Panera, P.F. Chang’s, Dunkin’, Rubio’s and Zaxby’s — has added or revised their programs to not only offer loyal customers discounts, but to also track customer data.

Closely monitor food inventory: Count inventory on higher cost items weekly, if not daily, and avoid over-purchasing as that can lead to expensive food waste, Patterson cautions. Employees with experience should be in charge of food ordering, she said. Restaurants can also sometimes benefit from reaching out to new suppliers to see if they can provide cheaper products at the same level of quality as what existing partners offer, she said.

Optimize menus: Restaurants are reducing their menu offerings. Thirty-one percent of operators report they have trimmed their menus, while 30% said they have substituted in lower-cost ingredients, according to Toast’s report. SpotOn suggests that operators should use point-of-sales data to determine which items sell well and which low-selling items can be taken off the menu.

Industrywide, menus are about 10% to 20% smaller per restaurant, Westra said, adding that restaurants have been using technology to better understand historical sales volume by day and by hour. Restaurants are using real-time operational financial dashboards like Microsoft’s Power BI and Salesforce’s Tableau to process historical sales volume by day or by hour, which has allowed them to be more discerning with menu cuts, Westra said.

While many operators have enhanced their drink menus, some have decreased the size of their food menus to focus on core items that are easy to source from their suppliers on a consistent basis, Patterson said. Smaller menus also allow restaurants to better manage food costs, and makes it easier to keep track of inventory. It’s also easier for a new employee to learn how to cook a smaller menu, she said, which can benefit restaurants struggling with turnover.

Promote higher-profit items: Operators should take inventory of top-selling items and higher-priced items to understand how those items impact costs, Patterson said. If operators can’t reduce portion sizes, higher-profit items can help boost margins. While owners are promoting these items, they aren’t pushing heavy discounts, Patterson said of her clients. Higher-profit items such as drinks can be promoted, as well as sides and appetizers that have low operating costs, she said.

Add menu items when it makes sense: If a restaurant is a differentiated concept with a narrow customer base, Patterson suggests that the operator add one or two things that can attract a wider audience. That could mean adding a burger to a sandwich menu if there wasn’t one before, or adding comfort foods to a menu at a vegetable-centric, healthy restaurant, Patterson said.

Beef up employee benefits: Many operators are adding health insurance, mental health benefits and retirement plans, such as 401Ks or IRAs with employer match. Benefits can help reduce turnover, which increases restaurant costs. New employees don’t produce as many sales as a tenured employee, and take time away from managers who have to train workers instead of allowing them to focus on growing sales, Patterson said. Controlling turnover also helps with overtime costs, she said.

Emphasize quality: With operators increasing price, Patterson said restaurants should advertise that they are still using quality ingredients and that the price increases will ensure that the quality of the product remains the same. Operators can communicate this quality by adding descriptions to their menu items on their websites, she said. Another way to emphasize quality is to make sure the restaurant is clean and customer service is good at every touchpoint, Patterson said.

“You will easily get whatever price that you put out there if you provide excellent over-the-top service in addition to great quality food,” Patterson said.

Adopt enhanced point-of-sales technology: Operators have been investing in point-of-sales systems that can help monitor menu pricing and manage inventory, Patterson said. Some have the ability to order products as well as schedule labor based on historical sales data. POS systems can help automate a lot of these processes, she said.

Employers should also lean into technology that makes schedule swapping easier for employees, Westra said, adding that the use of technology in general can help create a less stressful environment and chaos in the kitchen.

“If a manager has a tool now that does 90% of the work, they review it and then [approve] it and place the order or make the schedule,” Patterson said. “That saves them a lot of time and they’re going to focus on hiring, training and making sure product quality is correct, the restaurant is clean, that kind of thing.”