Dive Brief:

- In his first letter to Starbucks employees since taking the helm of interim CEO, Howard Schultz announced a suspension of the company's share repurchasing program, effective immediately. The Starbucks founder began his third stint as the coffee chain's lead executive on Monday, just weeks after Kevin Johnson announced his retirement.

- "This decision will allow us to invest more profit into our people and our stores — the only way to create long-term value for all stakeholders," Schultz wrote in a blog post.

- Buybacks, according to the Wall Street Journal, can buoy per-share profit and investor sentiment. Starbucks' shares are about $30 higher than they were in March 2020, despite a slide over the last quarter.

Dive Insight:

Buyback programs have been heavily criticized for eroding liquidity that may be needed in an economic downturn and because the investments don't generate revenue. The pandemic has proven the need for rainy-day liquidity, as well as the need for store and labor investments, as Schultz indicates.

In April 2020, Starbucks halted repurchases after taking an initial hit from the COVID-19 crisis. The company revisited buybacks in the fall of 2021, authorizing $20 billion in dividends and buybacks over three years. During its most recent earnings call in February, the company said it repurchased 31.1 million shares and had nearly 18 million remaining for purchase.

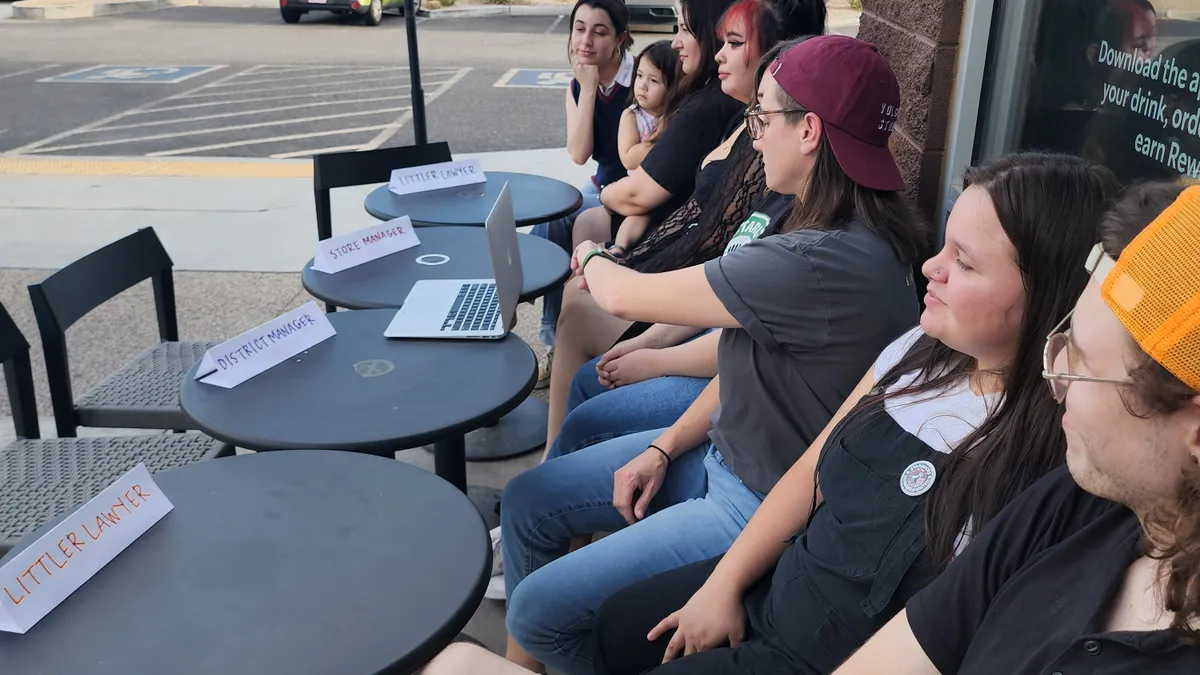

Buybacks have also contribute to financial inequality, according to the Harvard Business Review, as executives and shareholders benefit most from such programs. While hourly wages grew 4.7% in 2021, CEO compensation grew a record 19%. Such disparities, as well as lack of flexibility and desire for more job protection, have motivated employees at Starbucks and other companies across industries organize for unions. More than 180 Starbucks locations across the country have filed for union elections with Starbucks Workers United and 10 so far have voted in favor of unionizing, including New York City's Reserve Roastery location.

Reallocating money from share buybacks to employees and stores may provide a reputational win for Starbucks, which has been criticized by some policymakers and ESG investors for its response to the ongoing union drive. Starbucks Workers United claims the company has "relied on retaliatory practices to intimidate partners," including firing partners and closing stores seeking to unionize, for instance. The National Labor Relations Board has also alleged Starbucks may have violated labor law.

The suspension of the share buyback program isn't the only change Schultz promised in his letter to appease workers. He also plans to visit stores and manufacturing plants around the world for a listening tour, taking input from workers on the company's direction.

From there, Schultz plans to facilitate sessions with partners with an objective of creating a "multi-stakeholder era." Schultz and Rossann Williams, president of Starbucks North America, already attended listening sessions with workers in the Buffalo, New York market ahead of union votes there last year.

Starbucks' stock dipped about 4% after the suspension was announced Monday and dropped again Tuesday morning, indicating it may take some time for investors to warm up to Schultz's plan.