Dive Brief:

- New data from The NPD Group shows a significant improvement in restaurant sales from the early months of the pandemic. In December, customer transactions at major restaurant chains were down 10% versus one year ago, compared to a negative 37% in April when lockdown orders took effect.

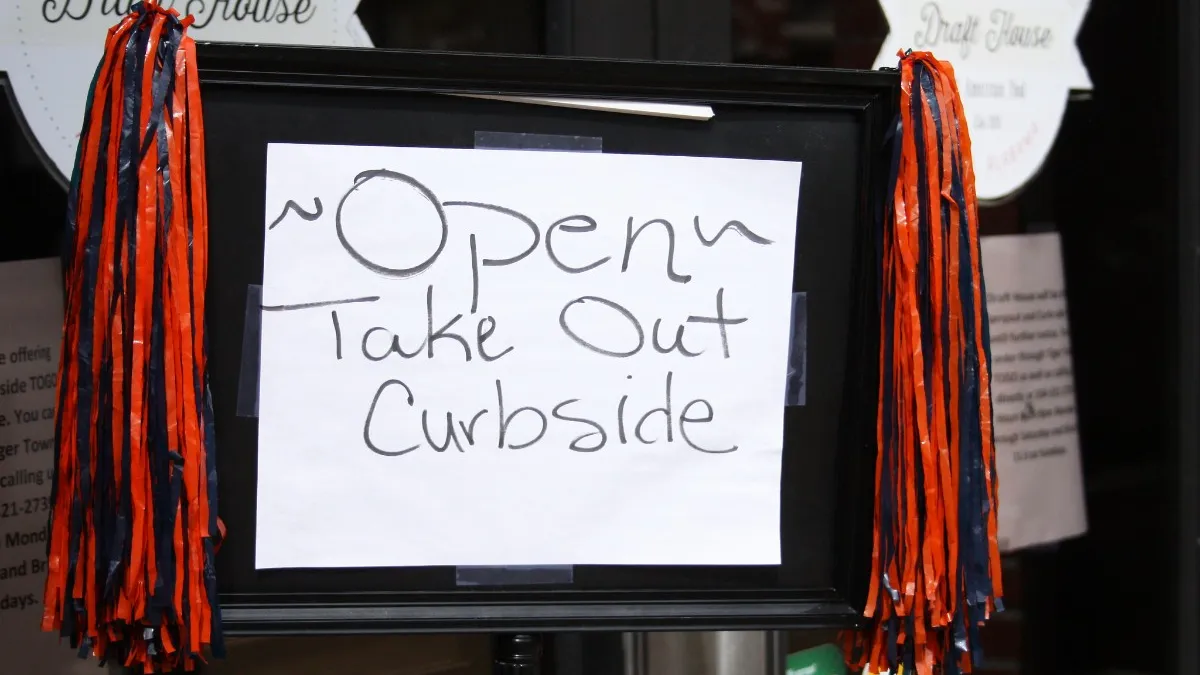

- The full-service category experienced transaction declines of 30% in December, versus declines of 70% in April. The 40-point improvement was largely driven by chains' quick adoption of off-premise channels, like curbside and delivery.

- Quick-service chains were much more insulated from pandemic disruption, in large part because of their drive-thru channels. In December, the QSR segment experienced transaction declines of 8% versus last year. This is compared to a decline of 35% in April.

Dive Insight:

Despite the material improvement in transactions from April to December, casual dining chains have a bumpy road ahead as a number of states bring back dine-in restrictions.

The NPD Group reports that full-service restaurants in more restrictive states are experiencing transaction declines of up to 70%. In less restrictive states, however, there is a smaller gap between full-service and quick-service transaction trends.

The drive-thru was popular prior to the pandemic, but it has become critical in light of dining room restrictions and consumer anxiety around safety. The gap between quick-service and casual dining illustrates why a number of casual dining chains have prioritized off-premise channels during the crisis. Some are even exploring new real estate models to optimize such channels. An Applebee’s franchisee, for example, will test a drive-thru pickup window early this year.

But consumers want convenient, contactless access to food whether or not a drive-thru is available, which is why the growth in off-premise — including delivery and curbside — is significant. At Darden Restaurants, for example, more than 55% of off-premise sales during the company's second quarter were fully digital, and off-premise sales grew 83% during the period. Off-premise comp sales increased by 144% at Applebee’s and 154% at IHOP, according to parent company Dine Brands’ Q3 earnings report.

As casual dining chains adopt off-premise channels, curbside may have the most potential for the segment. The channel is experiencing strong adoption from diners at QSRs, for example. In August, 40% of consumers said they use curbside more often than usual, according to a Bluedot and SeeLevel HX report. Curbside comes without the commission fees typically involved with third-party delivery orders, making it more affordable for both restaurants and for consumers than other off-premise solutions.

Integrating these channels with digital technologies for maximum efficiency can require a hefty investment, however. But shifting investment dollars into these digital technologies can help insulate operators from closures amid capacity limits, and could yield a strong return in the future if consumer interest in curbside pickup outlasts the pandemic. Digital sales, for example, are now expected to make up more than half of limited-service restaurants’ business by 2025, a 70% increase over pre-pandemic estimates.

This trend could translate to full-service as well. A recent report from Rakuten Ready, for example, found that casual dining had faster curbside pickup service than the QSR segment.

Dine Brands CEO Stephen Joyce is optimistic about the staying power off-premise, and said during the company’s Q3 call in late October, "We believe the convenience of takeout and delivery will remain appealing to our guests even as dining room restrictions are eased … With that said, we believe the guests returning to our restaurants for dine-in service will complement an already robust off-premise business and provide additional upside to sales."