Dive Brief:

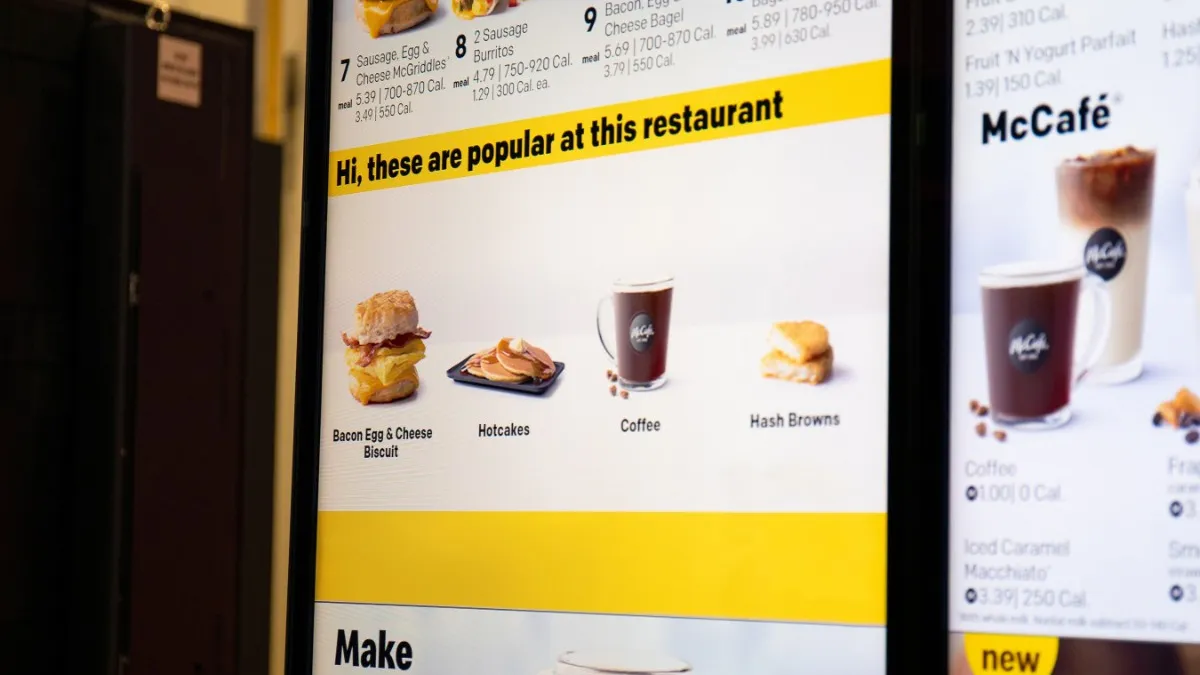

- Following its March acquisition of Dynamic Yield, McDonald's deployed a decision logic tree at drive-thrus at over 700 locations in the U.S. and already saw encouraging results with higher average sales. This technology will provide suggestive sales of additional items based on the time of day, weather and items the customer already ordered, McDonald's CEO Steve Easterbrook told investors during the company’s Q2 2019 earnings call hosted on Friday.

- The company plans to roll out this technology to drive-thrus in Australia, where it exists at 150 units, and ramping up rollout to 8,000 U.S. restaurants within two weeks. By the end of the year, the company expects to integrate this technology at all digital drive-thru menus across both of these markets, Easterbrook said.

- Easterbrook noted that one of the most encouraging signs of this rollout is the content management system, which is different in both of these countries, works well with Dynamic Yield’s software, meaning this technology is ready for an eventual global expansion.

Dive Insight:

McDonald’s executives have made it clear that its future will be one filled with technology, from the drive-thru experience to mobile ordering and delivery, and the earnings call solidified its strategy.

In addition to its fast Dynamic Yield rollout, it is improving the drive-thru experience by using diagnostic tools to find out where time is being spent the most. The technology monitors drive-thrus in real time, breaking down how long orders take, payments, food prep time and how many cars are asked to pull forward, Easterbrook said. This information is then used to create benchmarks statistics, allowing operators to see how their drive-thru times compare to other units within their local system or region, he said.

"Just with that attention, we're beginning to see notable changes," Easterbrook said. In June, drive-thru times in the U.S. were reduced by 15 seconds.

The Dynamic Yield technology also is expected to provide a more personalized guest experience, especially once the company can link customers' in-store, online and drive-thru orders. This connection will provide a better picture of each of its customers, Easterbrook said.

"I think that will be incredibly valuable for us to make ourselves more relevant and more interesting for those customers, and from a customer perspective, to make that experience smoother and more enjoyable," Easterbrook said.

With 79% of diners interested in personalized menus, this type of interaction will be key to retain loyal customers.

The company has also been using global forensics to analyze different complexities by market to identify slower moving items that don't sell many volumes and are slowing down overall operations, he said. The company has already removed signature and premium items from its menu because they decreased efficiency.

Using technology to improve operations and to customize the guest experience is becoming more common among QSRs. Starbucks' revamped rewards program uses blockchain. The coffee chain also announced this week it is licensing its technology through a new partnership with Brightloom to create an end-to-end cloud-based software for restaurants. In addition, Sonic is testing artificial intelligence at the drive-thru, while Chipotle is implementing more mobile and online technology for payment and rewards.

But none, except Starbucks, come close to the level of technology McDonald's is using at such a wide scale. This deployment will allow the company to stay ahead and provide a more connected and personalized relationship with its customers.