Dive Brief:

- Software company Olo filed for an initial public offering on Friday with plans to raise $100 million, according to an S-1 filing.

- As of Q4 2020, Olo processes 1.8 million orders per day and works with 64,000 restaurant locations and 400 brands, according to the filing. During the past year, the company posted a 94% increase in revenue to $98.4 million. The company said its gross merchandise value for 2020 was $14.6 billion.

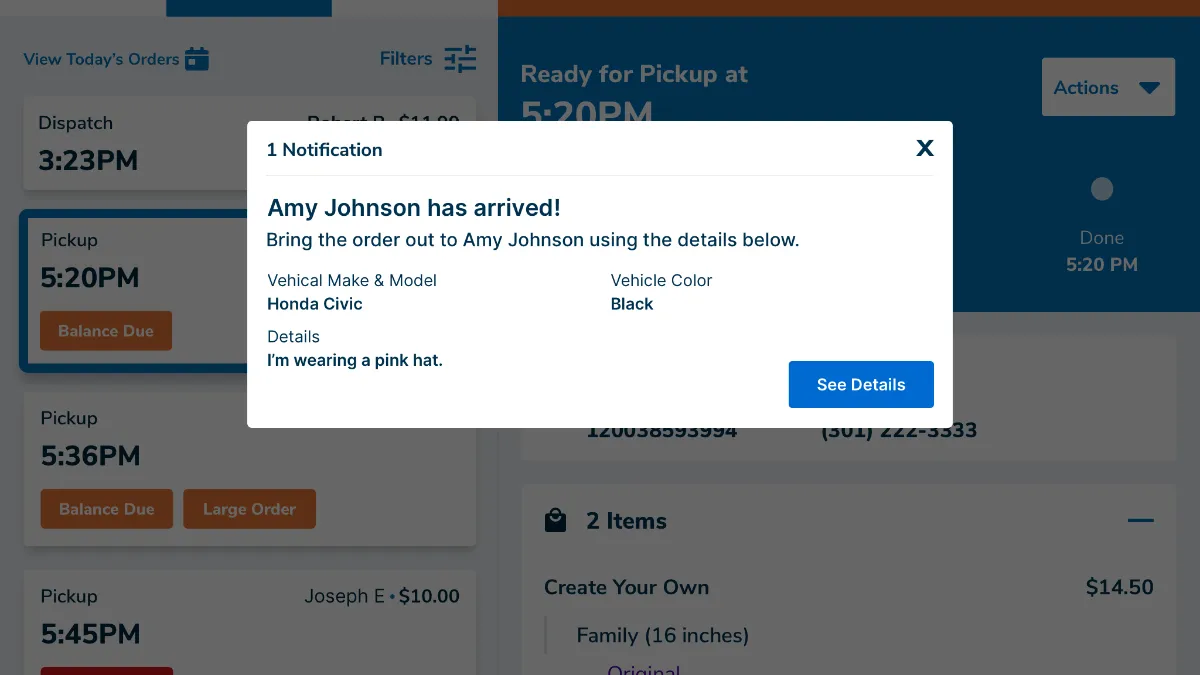

- In response to the pandemic, 70% of Olo's customers said in a survey they provided more off-premise delivery and pickup options. Olo adapted its offerings to include enhancements for curbside pickup and notifications upon customer arrival, according to a press release.

Dive Insight:

Growth in off-premise transactions will better position Olo during its IPO, especially with its customers increasing digital same-store sales by 156% for the month ended Dec. 31, 2020 compared to the month ending Dec. 31, 2019.

Olo's filing comes after DoorDash went public late last year, and as Toast is reportedly considering going public through an IPO or a special purpose acquisition corporation.

"Both direct and indirect digital ordering channels are powering this expansion," Olo said in the filing. "Aggregators created consumer applications to meet the growing demand for convenient restaurant food, helping expand off-premise dining. In addition, major consumer facing platforms are embedding food ordering into products such as maps and search results, making it even more convenient for consumers to place orders from their favorite restaurant brands."

In addition to enhancing curbside, the company added QR code functionality, kiosk ordering solutions and additional partners, the filing said. It launched a refreshed ordering platform dubbed Serve in September, which modernized its white-label product with features like faster ordering and checkout and menu redesign.

While Olo has focused on expanding off-premise tools for its restaurants, it also has ambitious plans for growth going forward. It wants to add new large multi-location and high-growth restaurant brands, targeting well-capitalized businesses, according to the filing. As these brands add new locations, the company said it is ideally positioned to organically grow revenue. The company said it sees its total addressable market opportunity at about $7 billion based on its current product offerings and focus on enterprise restaurants. It currently works with brands such as Chili's, Wingstop, Shake Shack, Five Guys and Sweetgreen, according to the filing.

Olo also wants to expand its current product functionality, including payments, on-premise dining and data analytics. The company sees on-premise dining as an area of increased opportunity for technology integration following the impact of the pandemic and is eyeing tabletop ordering. It is also exploring upselling additional products to existing customers, working with customers to enable higher transaction volume and growing its ecosystem of developers, user experience designers and other partners to better support its customers.