Dive Brief:

- Eighty-seven percent of industry operators, owners or managers believe technology adoption has been critical for survival throughout the COVID-19 pandemic, according to a "Global State of the Hospitality Industry" report from Lightspeed. Forty-seven percent of full-service operators and 37% of quick-service operators feel new technology is key for their businesses.

- Restaurants are also warming up to the idea of using automation technology to fill labor gaps, with 50% of U.S. operators planning to deploy this technology in the next two to three years.

- It's becoming crucial for restaurants to deploy technological solutions that ease labor pressure. The quit rate among hospitality workers has reached 6.8%, more than double the national average, and full-service restaurants are operating with 6.2 fewer kitchen employees than they were in 2019, according to the Bureau of Labor Statistics.

Dive Insight:

This staffing shortage coincides with reports from most American restaurant workers (62%) that guests are more demanding than ever, per the Lightspeed report, creating a major problem for an industry struggling to maintain service quality with fewer workers. In the U.S., 41% of operators say they are working with less staff than they need, and 48% of global operators report they have struggled to retain staff during the pandemic.

Many major restaurant chains are investing in robots to keep operations running smoothly despite the labor crunch. White Castle recently expanded burger-flipping kitchen robot Flippy to several locations, freeing up employees for other tasks. Saladworks has deployed Chowbotics' robot Sally, while McDonald's is piloting automated drive-thru ordering and Chick-fil-A is testing robot delivery.

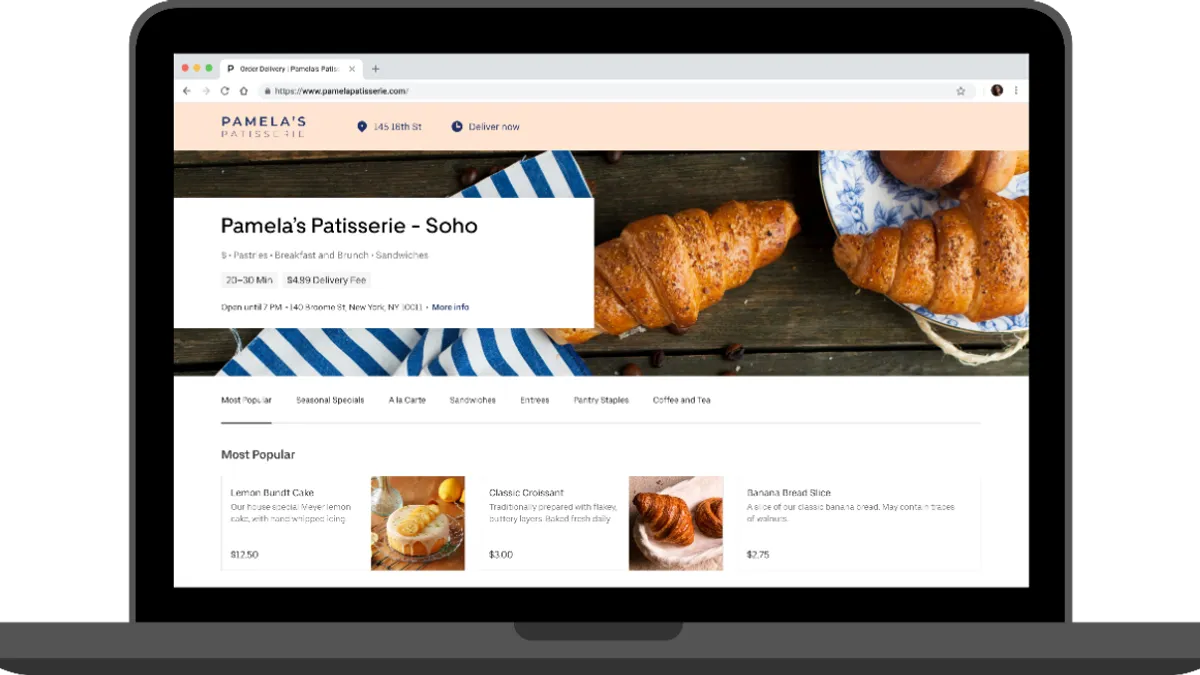

Automation may not be the most critical technology for restaurants in this challenging environment —according to Lightspeed's report, online ordering is "a must-have feature" in the eyes of consumers.

Digital ordering has grown by triple digits since the pandemic began, according to The NPD Group. Takeout orders facilitated by digital channels increased by 130% between March 2020 and March 2021, and consultant Donald Burns predicts in the Lightspeed report that takeout could be an even bigger business after COVID-19.

Lightspeed also notes that most consumers want to order directly from the restaurant versus a third-party app, which puts the onus on eateries to facilitate their own online ordering channels. Though this requires technology investment, both diners and operators can save money through native channel orders. SevenRooms research also found restaurants have done more work in the past year to incentivize such ordering behavior.

Consumers' tech preferences also extend to dine-in ordering and payment options, according to Lightspeed. Nineteen percent of U.S. diners say they would feel safer at a restaurant if QR codes and digital menus were available, while 20% want self-ordering at the table, per the report. Meanwhile, 30% of U.S. consumers say they expect a contactless payment option, even if it's not their preferred method. Currently, just 5% of Americans prefer to use contactless payment methods in restaurants, while 61% prefer to use a credit or debit card and 31% prefer to use cash.

Though the shift to a digital restaurant environment is accelerating, there is still a balance to strike for an industry founded on the hospitality extended by employees to customers. Research from JLL's Big Red Rooster finds that most (57%) consumers believe employees have more control over their dining experience than the brand itself.