Dive Brief:

- Takeout and delivery order frequency declined during the summer as restrictions eased and vaccinations ramped up, according to digital restaurant platform BentoBox's Q3 Restaurant Delivery Consumer Trend Report. In Q2, 50% of diners ordered takeout or delivery from a restaurant more than twice a week. That number fell to 35% in Q3. Those orders are expected to pick back up again as the COVID-19 delta variant continues to spread.

- More than half of diners surveyed (64%) said they will consider ordering in instead of dining out as the holiday season approaches. Forty-nine percent of consumers said convenience is the top reason they will order takeout/delivery for the holidays, while 39% of consumers said the rise in COVID-19 cases is making them nervous to dine out.

- Convenience also motivates most consumers to order directly from restaurants. Forty-six of all consumers say they're more likely to order directly from a restaurant if it's easy, while 44% say they're more likely to do so because of a promotion or discount.

Dive Insight:

As fears over the delta variant persist, dine-in business is likely to experience the biggest impact, despite the expected federal vaccine mandate, which split consumer opinion. One report shows that just 24% support vaccine requirements to dine indoors, for example, while 52% of restaurant operators believe such mandates will make guests feel more comfortable.

Takeout and delivery channel efficiency will be vital as the industry's recovery stagnates and consumer confidence slips. September's consumer confidence index was the lowest level since February because of the delta variant.

This trend is reflected throughout the industry. A September National Restaurant Association survey found that conditions are worse than they were three months ago due to continuing delta fears, labor shortages and supply chain issues. Meanwhile, restaurant sales were flat in August compared to July, according to the Washington Post, while reservations on Open Table have declined in the past two months.

The labor question has vexed operators, and several chains have trimmed hours or operations to navigate a shortage of employees. Understanding when consumers order off-premise more could help restaurants better navigate when they need to be staffed and where. Wednesdays, Fridays and Saturdays are busiest days for delivery/takeout, according to BentoBox's report. Thirty-nine percent of consumers order delivery/takeout on Friday, while 24% choose Saturday and 11% choose Wednesday. Conversely, just 4% of consumers order off-premise on Mondays, followed by 6% on Tuesday and 7% on Sundays.

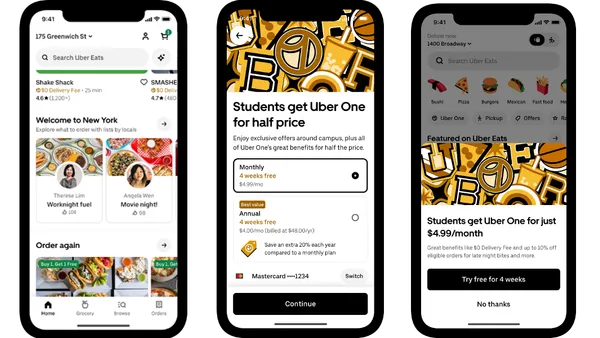

Perhaps the biggest positive from the BentoBox report is the shift in ordering preferences, with fewer customers saying they preferred to order from third-party aggregators. With just 14% of consumers citing the ease of ordering from third parties as driving factor in their decisions, down from 28% compared in Q1. Forty percent of surveyed consumers reported they preferred to order directly from restaurants because it would benefit those restaurants directly.

Having more consumers ordering directly could save restaurant operators money on delivery commission fees, which typically average about 30%. Despite shifting preferences, delivery companies continue to experience growth. According to Bloomberg Second Measure, 50% of U.S. consumers say they have ordered from a third-party company before, up from 44% a year ago.