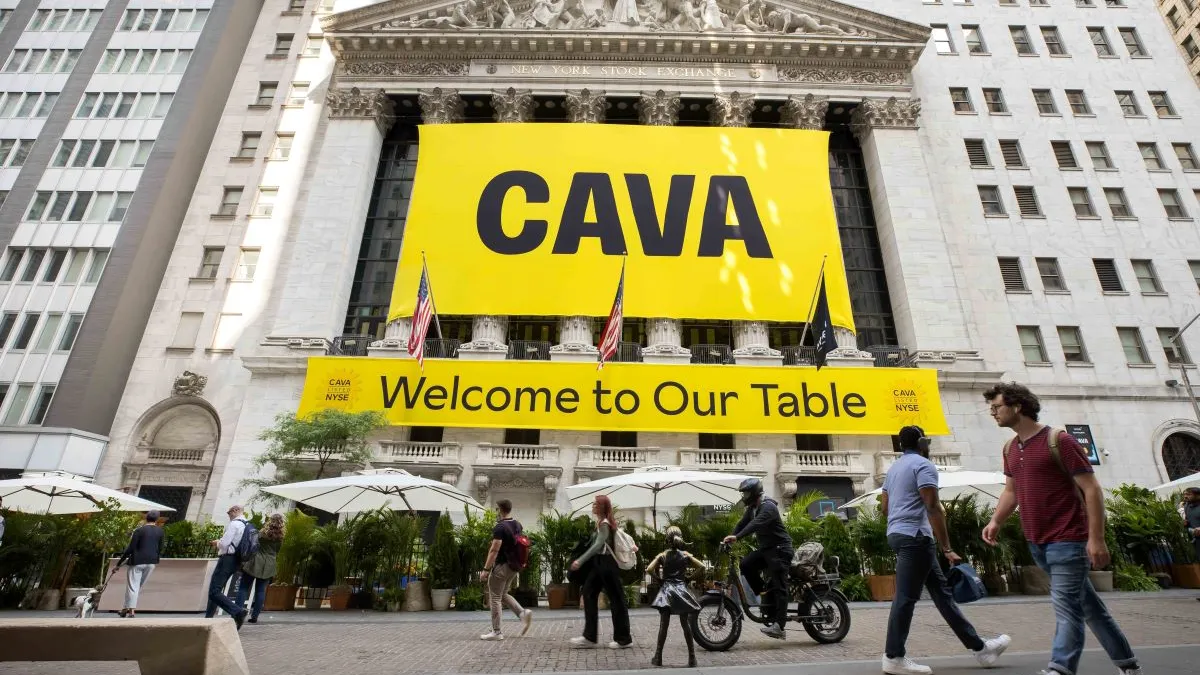

When Cava said it was going public, analysts were surprised. Compressed margins and profitability struggles made restaurants a tough sell for investors at the start of the year. But Cava defied expectations, raising a $318 million IPO last month. Two weeks later, Gen Restaurant Group gained over $43 million in capital, higher than initially expected.

More restaurants are expected to go public this year, too. Panera Brands revamped its executive suite to prepare for an IPO. Originally, it planned to go public through Danny Meyer’s special purpose acquisition company, but that deal fell through last year due to unfavorable market conditions. Panera Brands is now planning a traditional IPO. Pinstripes, however, is taking the SPAC route and plans to use its partnership with Banyan Acquisition Corp. to make its public debut.

Waiting in the wings is Fat Brands’ Twin Peaks, which Fat Brands Executive Chairman Andy Wiederhorn said is ripe to go public. Two years after Fat bought the chain for $300 million, its unit count jumped 40% and is expected to rise 100% in the next few years. Fat is planning for a $1 billion to $2 billion valuation for Twin Peaks, which could go public in the first half of 2024.

Learn more about the five chains sharing plans and strategies to go public during the first half of 2023: