Dive Brief:

- If new COVID-19 cases peak and start to decline in May, and shelter-in-place and dining-in restrictions are lifted in mid- to late-Q2, restaurants and bars can expect a 11.4% decline in business, Joe Pawlak, managing principal of Technomic, said during a State of the Industry webcast on Thursday.

- That number would jump to 17.2% if new cases plateau and decline beginning in late Q2 or early Q3 with restrictions lifted in Q3, he said, adding that the economy would be in a mild recession for the rest of the year.

- In the worst-case scenario where there would be a second wave of outbreaks come later in Q4, restaurants and bars could expect a decline in sales of 27.1%.

Dive Insight:

What makes it difficult to fully understand the impact the novel coronavirus pandemic will have on the restaurant industry is the fact that there has never been an event like this, Pawlak said. In past recessions, foodservice growth remained fairly healthy with only low single-digit declines during the Great Recession in 2009 and 2010, he said. Since March, the industry declined over 10%, according to Technomic data. Over $25 billion and over 3 million jobs were lost during the first 22 days of March, according to the National Restaurant Association.

Unlike past recessions, where demand to eat out declines, demand for restaurant meals is still healthy, and the industry can expect a spike in restaurant sales once things start to go back to normal, Pawlak said. In 2019, one in four eating occasions were at restaurants, he said. After the crisis subsides, people are going to come across the same time constraints they had before and won’t be cooking at home as often, he said.

But how big of a sales spike and for how long will depend on the length of shelter-in-place orders and the amount of restaurant closures, he said. According to the NRA, about 3% of restaurants have already closed with another 11% expected to close within the next 30 days.

“There will be fewer restaurants when we’re all said and done,” Pawlak said, adding there will be fewer units within large chains, especially with several franchisees that weren’t doing well prior to the coronavirus crisis. Even with additional franchisor support, some franchisees just won’t survive because they are cash-strapped independent restaurant operators, he said.

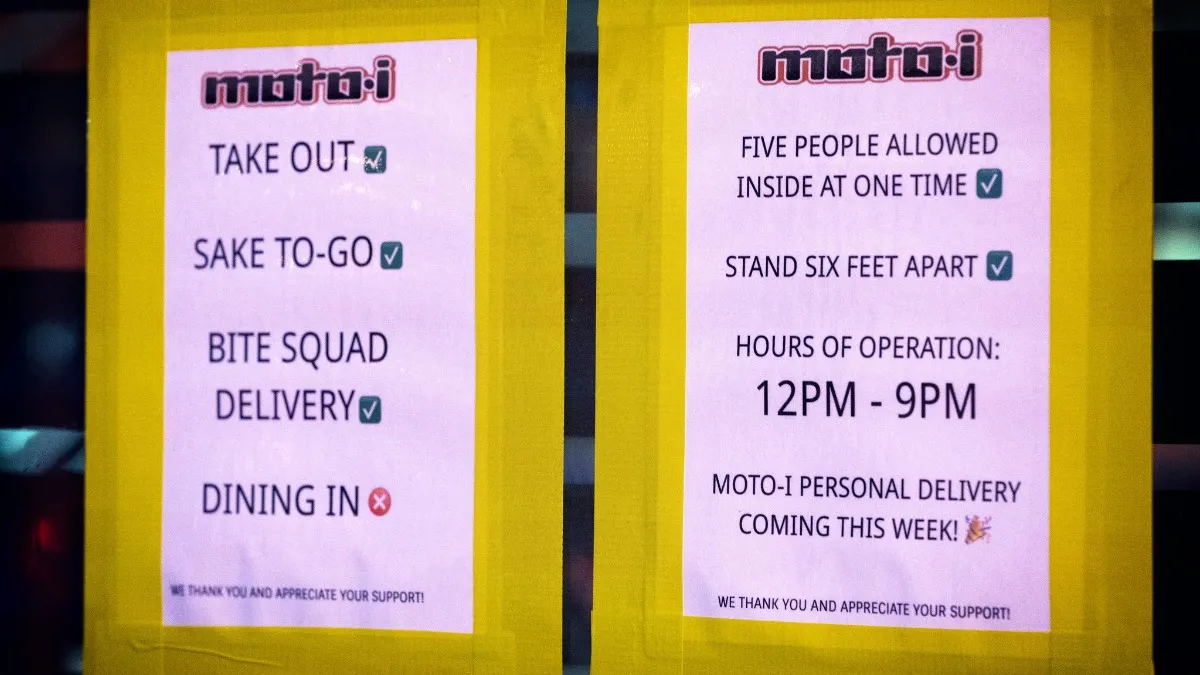

On the other hand, this crisis has already taught the restaurant industry ways to innovate quickly. Casual dining chains had to reinvent themselves and develop robust off-premise channels within a matter of days. Most, like Denny’s, Red Robin, IHOP and The Cheesecake Factory, had already been developing delivery and takeout channels. But this crisis led them to develop additional methods like contactless curbside pickup and partnering with additional third-party providers.

A difficult to reverse later, however, is the expectation of free delivery, which many chains are currently offering as a way to promote the channel, and will be difficult to take away from consumers that have come to expect it, he said.

Self-delivery also is getting a second wind, and some restaurants are having to find ways to make it work for them, which could result in more self-delivering restaurants post-crisis, he said.

Other shifts Pawlak mentioned that could take hold after things settle down is increased everyday sanitation, better labor efficiency with restaurants now working with skeleton crews, and increased need for value offerings, especially as consumers become more cash-strapped.

But despite the difficult months ahead, Pawlak expects the industry to come out with stronger suppliers, distributors, operators and employees.