Dive Brief:

- Uber will introduce grocery delivery in the U.S. this month through its main app and Uber Eats, the company announced Tuesday. The rollout will begin in Dallas and Miami, where the company recently soft launched with partner Cornershop, before expanding to other cities.

- The ride-hailing and meal delivery company launched the service Tuesday in 19 cities across Latin America and Canada. The company is partnering with chain grocers as well as regional players. In Montreal and Toronto, shoppers can receive deliveries from Walmart and Metro stores.

- Order collection and deliveries are performed by workers with Cornershop, the Chile-based grocery app that Uber moved to acquire last year, and can be fulfilled in under two hours. Shoppers with Uber Pass and Uber Eats memberships will get free delivery on any order over $30.

Dive Insight:

With its ride-hailing business down significantly during the pandemic, Uber has ramped up its meal-delivery operations and now has decided to finally plug into the skyrocketing online grocery market.

The company’s launch in Latin America and Canada includes 11 cities in Brazil as well as rollouts in Peru, Colombia, Chile and Canadian cities Montreal and Toronto. In the U.S., Cornershop debuted in Miami and Dallas earlier this year — primarily as a test-run to work out any kinks ahead of the Uber-focused launch, Daniel Danker, Uber’s head of product, said on a press call Monday. Uber bought a majority stake in Cornershop last October, and the final acquisition is pending regulatory approval in Chile, which Uber expects to receive in the coming days.

Uber is partnering with chain grocers as well as independent shops for its broader rollout, and says it offers tools to retailers like inventory management and order-picking technology. Executives declined to name any of the U.S. grocers that will offer delivery through Uber in the coming weeks and months.

The announcement comes just one day after Uber said it will acquire Postmates for $2.65 billion and signals the company’s intent to move beyond its core ride-hailing service. Uber Eats bookings increased 54% year-over-year in the first quarter of 2020. In the 30 countries where Uber has tested grocery delivery, orders have increased 176% since February, the company said. Postmates has already been delivering groceries, and Uber pointed out in a supplementary investor slide deck that the delivery platform was an "early player in delivery-as-a-service" and that the deal will accelerate these efforts. The company's tagline is "the food delivery, grocery delivery, whatever-you-can-think-of delivery app to bring what you crave right to your door."

“It’s really bringing us closer to our vision of being this one-stop shop for all customers’ food occasions,” Raj Beri, Uber’s global head of grocery, said of the move into grocery delivery.

Uber is entering a crowded field that includes Instacart, which reportedly just turned profitable and is now valued at $13.7 billion, as well as Amazon Fresh. Thousands of independent retailers are launching online platforms as grocery e-commerce surged past an estimated $7 billion in total sales in June. U.S. shoppers have also shown a preference for store pickup during the pandemic from chains like Kroger and Walmart.

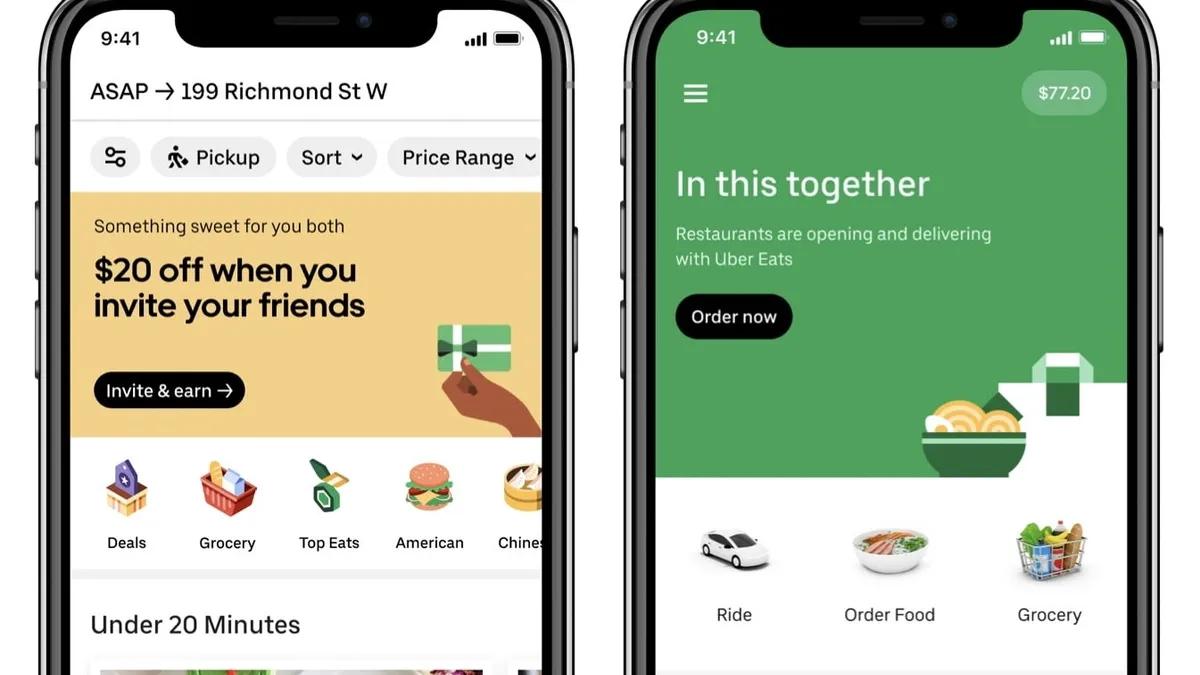

But the maverick firm will have the advantage of a very large base of customers and drivers to tap into. Shoppers can choose the grocery delivery tab from the main screen under the Uber and Uber Eats app, select their retailer and browse by category similar to other ordering apps. If they’ve used an Uber app before, their address and payment info are already saved in the system.

And while Cornershop workers will initially be performing the shopping and delivery, Beri said Uber drivers can sign up for grocery-delivery onboarding.

“The maturity and adoption rate of online grocery has significantly accelerated. There are a lot of customers that are or will be trying grocery delivery for the first time, and it’s important now to engage with the customers as well as the merchants,” Beri said.

Still, entering an adjacent delivery market via grocery may not be enough to inch Uber closer to profitability, especially when rivals DoorDash and Grubhub also offer the service. But the company's strong brand recognition, technology assets and increased market share — it's now second place in the U.S. delivery landscape with 35% of the market, while DoorDash boasts 45% share — could give it the edge it needs to make its offering superior to competitor services.