Dive Brief:

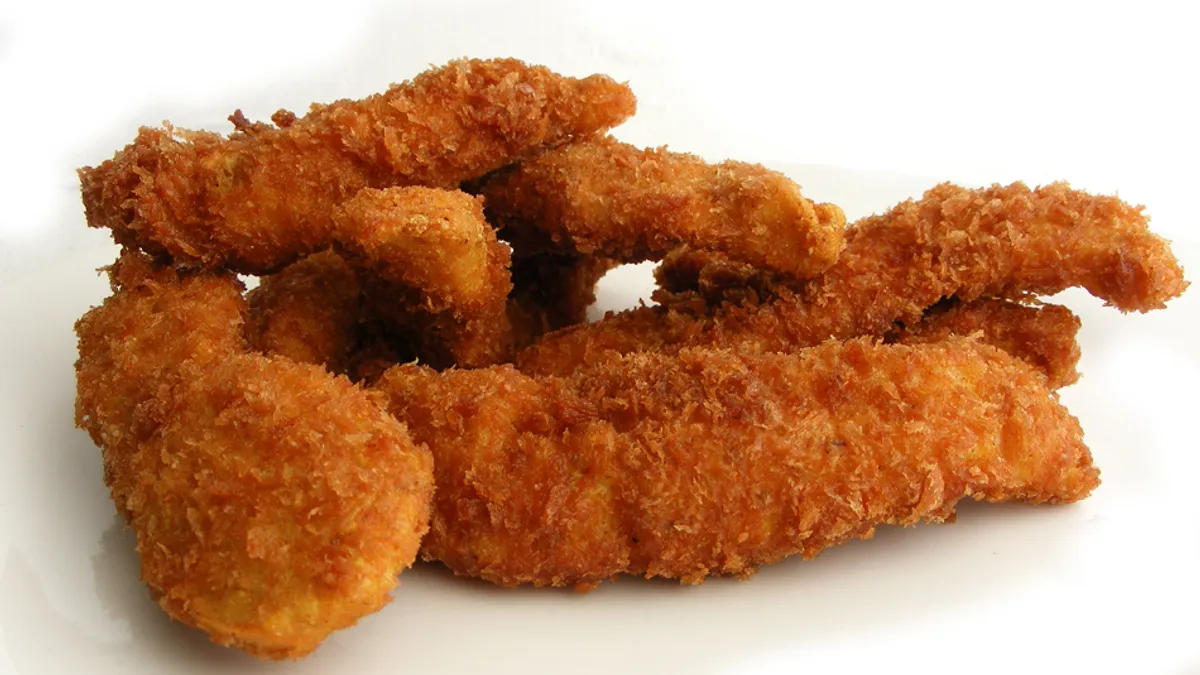

- Chicken strip servings were up 16% while chicken nugget sales declined 3% during the third quarter ending in September, according a press release from The NPD Group.

- But chicken nuggets aren't losing favor among buyers, and diners aren't switching their preference to chicken strips — the two products appeal to different consumers. NPD attributes the rising favor of chicken strips to product innovations at quick-service and fast casual restaurants.

- Over 2 billion chicken nuggets were ordered compared to 1.5 billion orders of chicken strips during the year ending in September.

Dive Insight:

Fried chicken products of all kinds have been increasingly sought after by consumers. Diners view chicken as a healthier meat option even if it has been fried, and operators have been adding more chicken to their menus following years of rising beef prices, according to QSR.

Chicken sales at quick-service and fast casual restaurants jumped 42.1% from 2011 to 2016, according to market research from Euromonitor. And momentum doesn't seem to be letting up. Pounds of chicken shipped to restaurants and foodservice outlets increased 4% during the year ending in September, according to NPD Group.

"Chicken strips have long been a consumer favorite, but when you take something that consumers already love and deliver value, or elevate the form as some fast casual concepts have, you have a strong platform for growth," NPD food industry advisor David Portalatin said in a press release.

McDonald's learned this all too well last year. Its buttermilk chicken tenders were so popular that it couldn't keep up with demand and had to suspend sales while its supply chain caught up.

Chicken-centric chains also have had tremendous sales and unit growth. Raising Cane's, which specializes in chicken fingers, has been rapidly expanding of late and reached 400 locations in 2017, according to USA Today. The chain has plans to expand to 600 stores and $1.5 billion in revenue by 2020.

But none have been as successful as Chick-fil-A. At the start of 2018, it was the eighth-largest U.S. restaurant chain and boasted 14.2% sales and 7.6% unit growth during 2017. Even though Chick-fil-A limits its unit growth to 100 per year, the chain is on its way to $10 billion in annual sales five years after it reached the $5 billion mark. Individual Chick-fil-A restaurants rake in over $4 million in sales while McDonald’s brings in $2.7 million per unit, according to QSR. KFC doesn't even come close, with an average of $1.2 million in sales per unit.