Dive Brief:

- Yum Brands sold its 2.8 million shares in Grubhub for $206 million during Q3 2020, according to an earnings release. In 2018, the company bought these shares for $200 million.

- The company still offers delivery through the platform, but has expanded delivery into 35,000 restaurants around the world, an increase of 11% year-over-year, with the addition of new aggregator partnerships, David Gibbs, Yum Brands' CEO, said during a Thursday call with investors.

- The addition of aggregator partnerships has allowed Yum to expand its accessibility to customers through whichever channel they prefer, Gibbs said. Digital sales also made up 30% of sales during the quarter, increasing more than $1 billion to a single-quarter record of $4 billion, according to the earnings release.

Dive Insight:

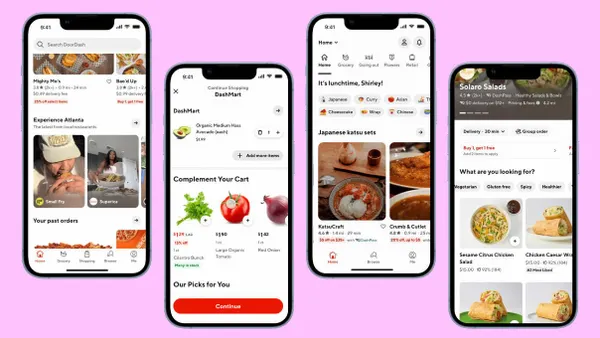

While Yum’s investment and exclusive relationship with Grubhub ended in a lawsuit in which Yum accuses the food delivery aggregator of improperly terminating its contract in June, Yum maintains a positive outlook over the potential that delivery can provide its brands. Taco Bell added DoorDash to over 5,500 restaurants nationwide in October and the company continues to expand its partnerships across its brand around the world. Eighty percent of KFCs now offer delivery, many through multiple aggregators, Gibbs said.

"It's ... a story of leveraging our scale," Chris Turner, Yum Brands' CFO, said. "When we bring our restaurants under those platforms, the economics improve for the aggregator and we’re able to take advantage of the economics for our franchisees and for Yum Brands. We think it’s a way to drive profitable growth for the system."

Exclusive partnerships are also rare these days as companies like McDonald's, Wendy's and Potbelly expand delivery with more aggregators. Only a handful of restaurants have stuck to single partnerships, with Wingstop, Outback Steakhouse and Brinker International maintaining exclusive deals with DoorDash.

Yum will also benefit by having access to aggregators that have more customers and scale, especially with DoorDash maintaining its market share lead this year. Selling its Grubhub investment will likely improve investor confidence, which eroded in 2019 when Grubhub struggled against growing competitors. It could also allow the company to reinvest the $206 million into more meaningful uses, such as improving technology and digital innovations, which are an ongoing focus for Yum.