The following is a guest post by Jenn McMillen, founder of Incendio.

Several monster-sized restaurant chains introduced loyalty programs in 2021, tempting millions of high-frequency diners across demographics with the benefits of spending their meal dollars at one chain instead of another.

For these restaurants, the benefits add up to more than a free bag of fries. Reward initiatives provide additional insights into a customer base that is at once local and transient, rich and not-so-rich, and of all cultures. A rewards program can help make sense of customer characteristics that are considerably variable. But one characteristic is consistent: these customers are hungry for loyalty programs.

Consider these fast facts:

- Forty-seven percent of restaurant customers use at least one loyalty program.

- Fifty-seven percent of restaurant loyalty program members said they would spend more at other restaurants if they offered loyalty initiatives.

- In 2020, the average restaurant rewards member spent $167 per month on meals eaten in-house. That's 92% more than non-rewards program members at the same restaurants. The carryout figure was even higher at $232.

- Still, nearly 40% of QSR customers do not use a loyalty program because their preferred restaurant does not have one.

If customers spend more money at restaurants that offer some kind of rewards program, then what's the hold-up? It may be that the QSR industry has historically enjoyed steady repeat business. But now with so many QSRs clustered in one geography, the customer's choice of Chain A or Chain B is often a last-moment decision based on parking, the drive-thru line, cravings or a coin toss. A rewards program serves up a good reason to choose one over another.

QSRs that want to introduce, change, or expand their reward options face three challenges:

Challenge 1: There's less room at the table. While 40% of QSR customers say their favored restaurants do not offer a reward program, more chains are joining the fray. In 2021, McDonald's, Burger King, Del Taco and Popeye's launched or piloted their first programs. This can lead to customer fragmentation that could threaten retention rates among existing programs.

Challenge 2: The number of people seeking "fast" rewards is climbing. Papa John's reported it gained nearly 1 million members in its Papa Rewards program between Q3 and Q4 2021. Chipotle reported around 2 million new members during the same period. If satisfied, these members will become more entrenched, making it harder for new programs to gain enrollees.

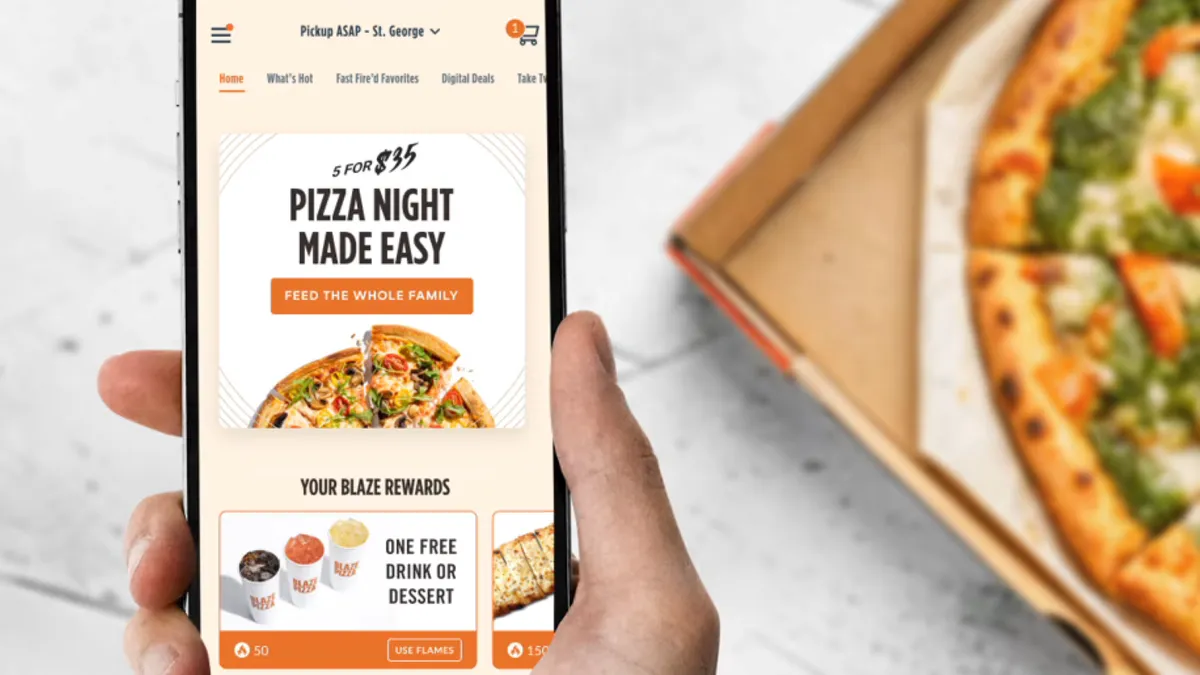

Challenge 3: App-based programs (which are a must) are bland. While some restaurants hurried to launch loyalty programs during the pandemic, many of these programs offer generic rewards, according to QSR Magazine. Many existing programs haven't innovated their apps with imagination-catching events, promotions and interactive communications.

How to overcome these challenges

These are obstacles the restaurant industry has the wherewithal to overcome. However, before launching (or relaunching) a rewards program, QSR leaders should consider the following:

Do your prep — learn what works for other QSR programs. Starting with the programs that operate within your target customer group, single out the elements that look most promising. Then do something similar, but better, faster, and with more personally relevant communications across app communications, text and email. Your customer data is your guide. For example, 32% of men eat fast food weekly, as do 28% of women. Thirty-six percent of people who eat fast food weekly are ages 25 to 38. Yet just 18% of Boomers and 27% of Gen Xers eat QSR weekly — is there an opportunity here?

Seek chocolate-and-peanut butter partners. Take into consideration the activities of your target members and determine if a brand partnership can enrich your reward proposition. Your target might travel frequently (hotel partnerships), spend a lot of time in the car (fuel rewards) or be a big sports fan (sports teams or ticket-purchase partnerships). Checkers partnered with the Tampa Bay Buccaneers in 2021 in a promotion that sent users coupons for free burgers whenever they texted a game-win code into their phones. Or a QSR can work with a competitor: Red Robin's partnership with Donatos allows Red Robin customers to order a Donatos pizza, for example, enticing members of both programs.

Recommend secret member menus. Members love exclusivity, and in the eating business, that means "me" menus. They can be permanent or limited-time offerings. The key is to attract new members and to encourage existing members to visit more. What if Chipotle, for example, added a hot-sauce condiments cabinet just for members of its Chipotle Rewards program? Members could access the cabinet using a code, and tempt non-members to enroll so they too can get their hands on a Cholula bottle.

Be sure you're equipped to be "biggie-er." Companies entering the rewards fray or looking to gain members will do well to regularly assess their capabilities and ensure they can grow and maintain their digital platforms as they expand. Include features that matter to your customers, such as nutritional information or free coffee upgrades. Del Taco's Del Yeah Rewards app encourages members to climb four tiers (Queso, Scorcho, Inferno and Epic) with special challenges, badges, exclusive experiences and surprises (such as quarterly free food bonuses at some tiers). And all members get free coffee with any purchase before 11 a.m., daily.

A rewards program can positively shake up the value of a quick-serve restaurant if a QSR first invests the time to ensure the program offers the right menu of features, such as unexpected rewards, immediate earnings and redemption and a digital element that is visually enticing and instructive.