2019 was a year of growing pains — and opportunity — for the restaurant industry. The rise of AI-outfitted drive-thrus, robot-enabled kitchens, autonomous delivery vehicles and growing frustration with third-party delivery aggregators further fueled restaurant hunger for tech. An unprecedented labor shortage and rising minimum wages heaped extra pressure on operators, and the market will continue to carry this burden into 2020, analysts predict.

Total customer traffic is also expected to be flat, with QSRs increasing customer traffic by 1.6%, David Portalatin, VP and food industry advisor at The NPD Group, told Restaurant Dive.

"That is more optimistic on what our outlook has been over the past few years," he said.

But the new year will also bring new paths to revenue, analysts told Restaurant Dive. The growing spending power of Gen Z is the perhaps the strongest undercurrent of predicted changes, with experts anticipating the consumer base will drive investment in experiential LTOs, lifestyle campaigns, the growth of micro chains and more.

Here are five trends expected to shape the restaurant world in 2020:

1. Lifestyle campaigns and LTOs will be key to marketing

Last year, more and more restaurants attempted to secure the coveted status of "lifestyle brand" by investing in wacky and Instagrammable merchandise, including Popeyes' "ugly" Christmas sweater and a Colonel Sanders faux bearskin rug from KFC.

The trend will continue to be prevalent among QSRs in 2020 since this model doesn't allow for as many dynamic in-store experiences as fast casual and casual dining. Miranda Lambert, former Euromonitor analyst and current project manager with the Energy Institute at UC Berkeley, told Restaurant Dive. The strategy is eye-catching and can garner social media buzz, but Lambert said that deepening diner loyalty is the main aim of the tactic.

"The reason for that too is customer retention," Lambert said. "I think once those brands obtain loyal customers, they try to really keep [them] ... consumers are less interested in experimenting in the limited-service space than in others. [A diner] is probably less likely to switch from McDonald's to Burger King as their go-to restaurant as they are in a full-service restaurant."

In 2019, the lifestyle brand marketing wave also tapped into consumer demand for experiential living. Many restaurants delivered on this with branded restaurant pop-ups, but Taco Bell and Nutella Cafe also launched hotel pop-ups where guests could book a stay in an immersive experience.

More restaurants will experiment with promotions like these as interest in branded experiences across retail, hospitality and foodservice converge, Lambert predicts.

Brands will also continue to lean into specialty LTOs as a way to pique consumer interest and drive social media engagement. The trend saw the strongest adoption in beverage and coffee specifically, Lambert said, with non-coffee brands offering specialty coffee drinks to try and create the same excitement that Starbucks enjoys from its seasonal offerings. Chick-fil-A, for example, launched a salted caramel iced coffee test in Virginia and South Carolina.

"[LTOS] are a way to garner interest without having to put something permanently on the menu," Lambert said. "Brands are committing to fads among consumers more readily… they will craft new menu items that [fit] with whatever is in style at the time and when it decreases in popularity a little bit, they'll drop the item and turn to a new seasonal offering."

Products like this can drive both visitation to the restaurant and frequency of visits, Fred LeFranc, managing partner of Results Through Strategy, told Restaurant Dive, which could help differentiate brands in 2020.

"Take a look at a McDonald's with their McRib. It's not a sustainable model to have it on the menu year-round, but it does a great job of driving traffic and [is] a temporary lift [during] parts of the year," LeFranc said. "I think the more restaurant marketers [work] in conjunction with their culinary departments, the more they're going to start driving visitation using food items that create intrigue."

2. Menus will shrink and simplify

In 2019, major QSRs began phasing out artisan-style menu items to reduce operational strain and diners' choice paralysis. McDonald's, for example, announced in April that it was removing its Signature Crafted Recipe burgers and sandwiches just two years after rolling out the suite of items. The move makes sense — earlier last year, McDonald's CFO Kevin Orzan said during a conference that premium menu items were slowing drive-thru times because they take longer to make.

This year, menu simplification will sweep through restaurants of all categories, LeFranc said.

"If you can streamline your menu, you can do so much more to improve your efficiencies, the quality of the product, the order time for the customers," he said. "If you take a look at the mono-concepts like In N Out, Chick-fil-A and Raising Cane’s, they have very, very small menus. They do really high volumes for all of these reasons."

In 2017, Chili's also trimmed its menu by about 40% to improve throughput.

Restaurants will streamline their offerings as a way to reduce reliance on labor, as extra employee training is needed to make complicated menu items, Euromonitor research analyst Matt Godinsky told Restaurant Dive.

"If you streamline your menu, you can do so much more to improve your efficiencies, the quality of the product, the order time for the customers."

Fred LeFranc

Managing Partner, Results Through Strategy

But that doesn't mean that restaurants won’t get creative with their offerings.

Analysts agreed that plant-based menu items — and especially plant-based meat — will continue to be star players on restaurant menus and a way for chains to appear on trend. But it's important, LeFranc cautioned, to ensure that new products are true to a restaurant brand’s persona.

"There's always the fundamental question of 'Does it fit my brand? Can I get credibility?'" LeFranc said. "Let's take Burger King for example — they're really branding the Impossible Whopper, right? [They're] using someone else's brand equity to legitimize their product offering … that's an interesting phenomenon."

Despite the fervor for this growing category, restaurants and manufacturers will need to continue to improve these products to maintain demand, NPD analyst David Portalatin told Restaurant Dive.

"A lot of the momentum that we've seen in the foodservice space is a part of basic consumer desire for more diversity of protein in their diet," he said. "It is also really an innovation story, so in order to keep that momentum going I'd expect to see … expansion beyond just burgers into other types of protein alternatives."

3. Ghost restaurants will mature

While 2019 was marked by startups expanding their ghost kitchen spaces, 2020 will see further expansion and new partnerships, especially as these spaces create an avenue to grow a restaurant's delivery channel without disrupting in-store operations, analysts said.

"You’re going to continue to see exploration around this idea of the virtual kitchen and ghost restaurant … where we're thinking about how to create a different brick-and-mortar model that better facilitates the economics of delivery," Portalatin said.

While ghost kitchens dropped off a few years ago, they are now working more with restaurant companies and suppliers, Aimee Harvey, managing editor at Technomic, told Restaurant Dive. For restaurants, that has meant providing a way to expand into new markets without having to invest in real estate for a brick-and-mortar location, Harvey said.

Restaurants are already starting to separate themselves from third-party ghost kitchens and are developing their own kitchens. Corner Bakery in Los Angeles, where half of its business is delivery, is building its own ghost kitchen, LeFranc said. Chick-fil-A and Outback are also looking into these concepts.

And the ghost kitchen segment is only going to get bigger, especially with third-party delivery providers, such as DoorDash, getting into the segment, Harvey said.

"The fact that DoorDash is getting into this as a new channel for their business really speaks to the direction that [ghost kitchens are] headed and that it is not just a commissary kitchen," Harvey said. "Different restaurant brands can share a common ghost kitchen, but working hand in hand with delivery is really going to be the next sort of extension of the trend."

4. Micro chains will be flavor trendsetters

The next emerging fast casual concept is going to emerge from a growing class within the industry: micro chains, Portalatin said.

Micro chains, which typically have three to 19 units, have become the industry's innovators. These full-service and quick-service chains tend to be chef driven, and Portalatin said they are the creative class in the industry. Micro chain QSRs are increasing their operator spend year-over-year by about 8%, Portalatin said. At that rate, the successful QSRs will emerge as a small chain and potentially attract an investor, like a private equity firm, that could help it become the next big fast casual chain.

These chains tend to offer bold, ethnic flavors and many have been using ingredients like sambal and harissa as well as Asian flavors, such as Korean barbecue, Portalatin said. Micro chains also are more likely to have a strong sustainability stance and are experimenting with various concepts like plant-based straws or plant-based proteins like sausages, fish and eggs, he said. Some have also been trying carb alternatives such as cauliflower pizza crust, he said.

"They are more likely to be the kinds of restaurants in tune with many of these consumer trends," Portalatin said. "They are accommodating a lot of different consumer choices."

5. Gen Z is gaining more influence

Gen Z, who were born between 1996 and 2010, is the youngest adult demographic and a growing restaurant consumer. Peak restaurant consumption tends to be during someone's late 20s and early 30s, Portalatin said. While Gen Z is just entering this stage, its influence will only grow, he said.

"We're going to be helped going forward by the emergence of Generation Z," Portalatin said. "Every single year forward for about the next decade, Generation Z is going to eat more restaurant meals than they did the year before."

Some are beginning to drive while others have graduated college and started their first jobs, Harvey said.

"What does that mean for pricing thresholds and how important is pricing and value to them?" Harvey said.

Other trademarks of the generation that restaurants need to account for are the generation's preference for fast casual concepts and ethnic flavors, as well as their desire to be food explorers, Portalatin said. They are also more driven by speed of visit, convenience and free WiFi, Harvey said.

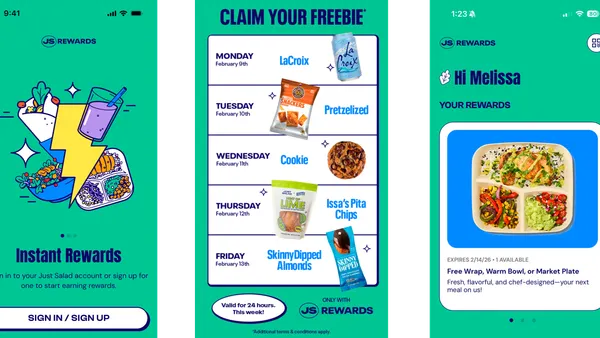

In addition, Gen Z's growing influence will mean restaurants need to make sure they offer more frictionless experiences and easy ways to order digitally.

"If you think about it, this is the generation that knows hot to FaceTime their friends, text their moms and order a pizza all at the same time," Portalatin said. "This generation is more fluid in terms of both how they work and … how and where they eat."

The demographic also typically expects food to come to them and favors more delivery, takeout and meals at home. They eat meals on a park bench or at a beach or other locations, Portalatin said.

"I think digitally ordered takeout will be one of the fastest growing trends in 2020," Portalatin said. That could mean better profitability and better margins, he said, but restaurants will need to rethink operations, the flow of store traffic and how to deliver a frictionless experience, he said.

Social responsibility and a company’s values also are more important to Gen Z than previous generations, Portalatin said.

"The key there is going to be authenticity," Portalatin said. "Don't think you can fake it with that generation. [Your values] have to be a genuine outgrowth of who you are as a company."

Gen Z care more about the story of how food is grown and how a restaurant is partnering with sustainable farmers or providing ways for customers to purchase food leftovers at the end of the day to limit food waste, Harvey said.

"The key there is going to be authenticity. Don't think you can fake it with that generation. [Your values] have to be a genuine outgrowth of who you are as a company."

David Portalatin

VP and food industry advisor, The NPD Group

"Where the customer can actually see the good, the responsible part of social responsibility be put into actual practice, … is going to matter more to them," Harvey said.

While Gen Z's influence hasn’t been fully felt within the restaurant industry, restaurants are already in good shape to meet the growing needs of this digital-centric generation. The biggest thing for restaurants to keep in mind is better identifying who their core customer is and then prioritize how to invest around whether that customer wants a convenience and delivery platform or create a unique dine-in experience, Harvey said.

"There hasn't been as much success in trying to be everything to everyone," Harvey said.

Balancing all Gen Z's preferences alongside a need to provide technology will be among the top challenges for restaurants in 2020 and beyond.

"I think everyone wants to satisfy Gen Z and millennials and boomers and everyone in between, but I think that technology advancements are really going to guide a lot of how restaurants pivot in order to make that happen," Harvey said.