Dive Brief:

- Chipotle will invest another $50 million in its Cultivate Next venture fund, doubling the money it has put into the fund, which launched in 2022 to support companies working on technologies Chipotle wishes to integrate into its supply chain or operations.

- The burrito brand said the new funds would help it expand its existing portfolio, which currently includes investments in robotics, agricultural market platforms, fertilizer and meatless proteins.

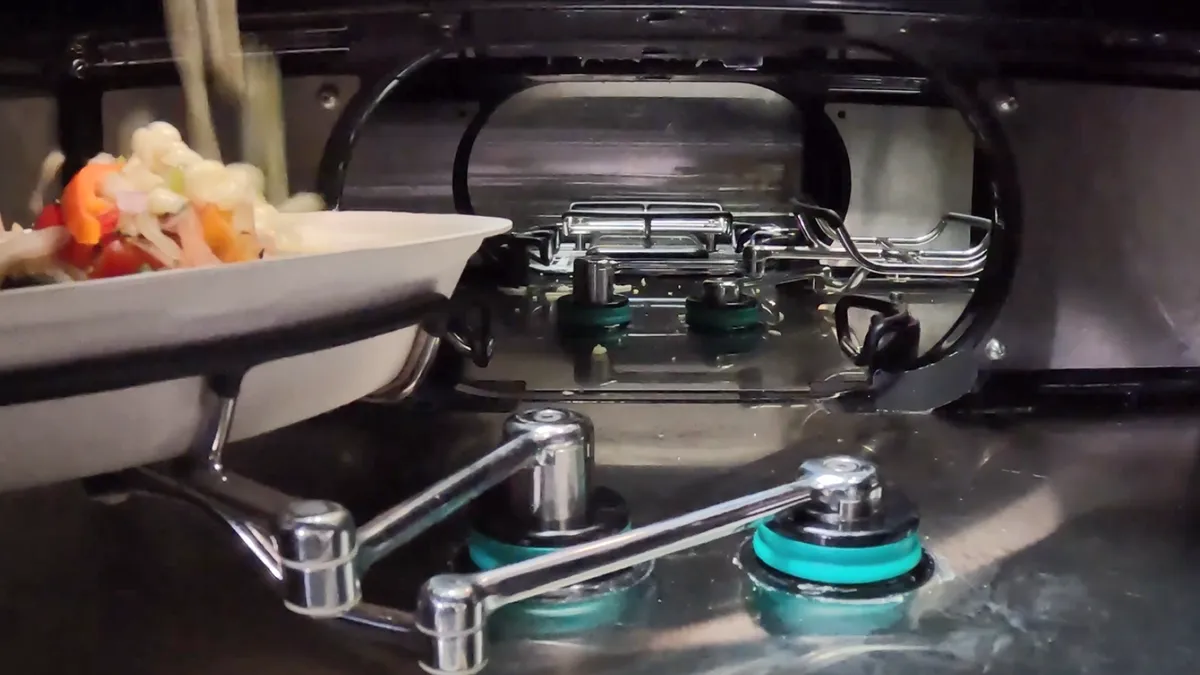

- Chipotle has already begun testing products developed by two of the companies backed by the Cultivate Next fund: Vebu’s Autocado and Hyphen’s automated makeline. The company believes this tech will eventually enable it to improve throughput and labor productivity.

Dive Insight:

The strong performance of companies Chipotle has invested in so far is a driving factor in the additional investment, Cultivate Next Manager Christian Gammil said in a statement. The company aims “to scale our efforts and drive real change in the supply chain, agriculture, restaurant innovation, and automation sectors,” he said.

The investments in equipment have yet to be deployed at scale, but the company intends to test them further this year, CEO Brian Niccol said on Chipotle’s Q4 2023 earnings call. The company has not publicly commented on how it could ensure the automated makeline could be made safe from contamination after Restaurant Dive noted promotional materials for the device showed ingredients bouncing out of bowls when dispensed.

“We plan to pilot the automated digital make line and Autocado in a restaurant in 2024 as part of our stage gate process,” Niccol said. Niccol also said the company’s investments in various startups in agriculture could “play an important role in ensuring a more sustainable future for farms within our supply chain.”

Niccol identified morning prep tasks as a particularly important area for the company to speed up work, and said that in addition to the Autocado, Chipotle was interested in “other robotics to help us cut the onions and the jalapenos, these things would be huge enablers.”

Chipotle has said it is facing a steep increase in labor costs in California, with wage increases there potentially costing an additional $74 million per year, relative to its costs in the absence of the AB 1228 $20 fast food minimum wage. That wage growth is pushing the chain to hike prices in California, and may be a motivating factor in further investments in restaurant tech.