Chipotle’s Q3 same-store sales increased 5% year over year, the company announced yesterday. Traffic also held steady, including with low-income consumers and younger adults with student debt, CEO Brian Niccol said on the company’s earnings call.

Niccol said the chain’s “operators have done a terrific job of getting back to the basics of staffing, training, deploying, and then holding ourselves accountable to great throughput.”

Chipotle's same-store sales growth

Chipotle’s visits were up throughout the third quarter compared to overall dining, per Placer.ai data. Visits rose 11.6%, 9.9% and 4.7% in July, August and September, respectively, compared to last year.

But there were three labor-related areas where the chain’s outlook is less optimistic.

A 20% wage hike in California

In California, where QSR brands will have to pay a $20-hourly-minimum wage beginning in April in the wake of AB 1228, Chipotle’s average wages are about $17.

“It's going to be a pretty significant increase to our labor,” Chief Financial Officer Jack Hartung said.

Because the average wage at Chipotle is below the new minimum, the chain will have to increase pay above that level for some workers to compensate for wage compression. Hartung said the chain intends to pass the cost of the wage increase on to consumers.

“We are definitely going to pass this on,” Hartung said. “We just haven't made a final decision as to what level yet.”

Hartung predicted the price increase would be in the mid-to-high single digits. The company clarified in an email to Restaurant Dive that the price increases would be restricted to California.

Given that California makes up roughly 15% of the company’s system and the chain’s labor costs are 24.9% of total revenue, according the chain’s most recent 10-Q, California labor currently is equal to at least 3.75% of total revenue, likely more given that California is already a relatively high wage state. This means the wage hike due to AB 1228 would, at a minimum, account for about 0.75% of the chain’s total revenue, equivalent to about $18,539,610 in Q3 2023, or $74 million annually, likely more.

Power hungry grills

The chain has been testing dual-sided grills at 10 units. Analyst BTIG previously predicted that “with $1.8B in cash, we believe Chipotle could aggressively roll out these grills in the near future.” The grills speed up the cook time for meat, potentially aiding the chain’s effort to drive throughput and speed up its operations during peak hours.

Niccol said the initial tests of the grills revealed unexpected, potential issues. The grills need a good deal of electricity, Niccol said, so much that some restaurants will need electrical upgrades to power the grills properly. The cost those power upgrades change the anticipated economics of the grills.

“We got to understand exactly what is the cost of the equipment, not only to purchase, but then to actually install,” Niccol said. “The crew likes it, the culinary turns out to be great. But we have to do some work on the economics of it.”

The robot future isn’t here yet

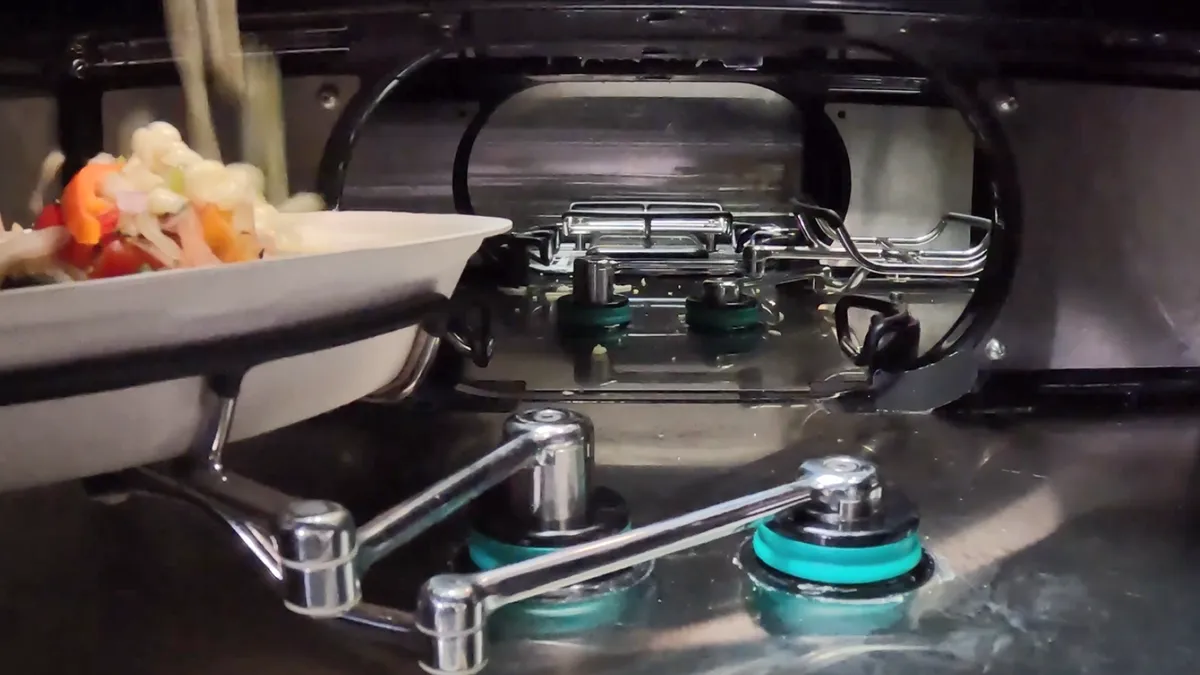

Similarly, Chipotle’s stage-gated testing system showed there’s work to be done with the chain’s Hyphen makeline and Autocado robot.

“We still have some iterations to make the Hyphen and Autocado before they are ready to be tested in a restaurant,” Niccol said. “I am excited about the progress the team is making.”

Specifically, with the makeline, “there's work to be done on how you clean it, there's work to be done on how we actually provide portions,” Niccol said. Still, Niccol said the company was happy with the results of the testing.

Promotional material for the Hyphen makeline showed potential food safety and cleanliness issues, with ingredients bouncing out of bowls and landing in the machine.

“What we're after is accuracy, speed and then the ability for the team member to execute this both at the expo station and then keep it clean and food safe,” Niccol said. “But for a very first prototype, the team did a great job.”