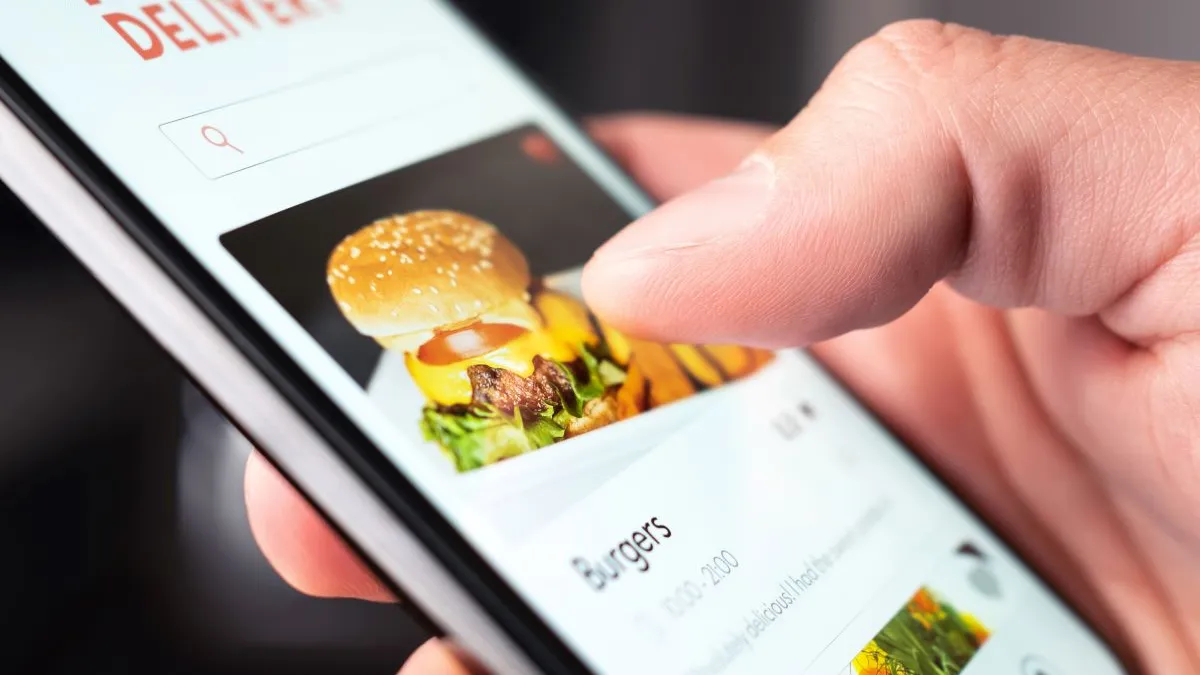

Off-premise traffic — including drive-thru, takeout and delivery service — remains a major business driver for restaurants as diners prioritize convenience, according to three recent industry reports.

Nearly half of restaurants said off-premise business made up a higher percentage of business last year compared to 2019, according to the National Restaurant Association’s State of the Restaurant Industry 2024 report emailed to Restaurant Dive. Of the surveyed restaurants, 43% of full-service restaurants and 55% of limited-service restaurants said off-premise accounted for more business than it did five years ago. Just over one-third of operators said they expect off-premise sales this year to be higher than last year, while 55% said they expect this channel to be about the same.

According to TouchBistro’s The State of Restaurants in 2024 report, 46% of operators are planning to add more off-premise ordering options, like takeout and delivery, as a way to boost revenue. A bakery and cafe general manager cited in the TouchBistro report said that they are still offering third-party delivery, but now allow customers to pick up food directly from the restaurant, which can help save on costs, given the fees third-party platforms charge consumers and operators.

Online ordering platforms continue to be a key part of operators’ strategies despite ongoing concerns over the cost of third-party commission fees, and 95% of operators said they are using at least one online platform, per Touch Bistro. Uber Eats was the top platform, with 68% of operators reporting they partner with the delivery aggregator, while 36% said they were using a direct ordering platform. On average, operators use three online ordering solutions, per TouchBistro.

“As businesses become more profit focused, they’re going to look at where they’re giving away margin,” said Bryan Solar, chief product officer of SpotOn. “Having a great self-owned ordering experience is going to be really important.”

Use of direct online ordering rose to 36% in 2023 from 34% in 2022, which TouchBistro said suggests that operators are using this method as a way to save on commission fees. While commission fees average about 15%, a plurality of operators (34%) tend to pay 6% to 10% and 27% say they pay 11% to 20%. Only 24% of operators say they pay commission fees of over 21%.

“Undoubtedly, consumer demand for takeout and delivery has subsided since the height of the pandemic. However, it has never flatlined in the way some experts predicted,” TouchBistro said. “In fact, restaurants still report doing nearly a quarter (23%) of their business through online ordering platforms, on average.”

Consumers still like takeout and delivery

Diners continue to prefer off-premise ordering as well, with 52% saying that takeout is “an essential part of their lifestyle,” according to NRA's report. More than half of consumers also said they would supplement a home-cooked meal with a prepared item from a restaurant, such as an entree, side or dessert.

Similar observations abound in William Blair’s The Dining Download report, which highlighted various digital trends. Convenience and time constraints represent the top reason for 69% of consumers choosing to order delivery or takeout, according to William Blair’s report.

Over one-third of respondents in William Blair’s 2023 survey said they order more delivery and/or takeout since 2019, compared to 23% who said their ordering decreased.

“Off-premises eating … remains more frequent than in-person eating, and our survey supports that the pandemic may have structurally changed consumer behavior,” analysts at William Blair said. “Once again, more respondents said that over the last year their frequency of ordering takeout had increased than decreased.”

Younger generations continue to be the top demographics regularly ordering takeout, with 67% of millennials and 63% of Gen Z adults saying they do so, according to NRA’s report.

Roughly two-thirds of consumers said they used third-party delivery in the past six months; the channel remains popular among young cohorts, as well. More than seven in 10 Gen Z adults said they used third-party delivery, compared to about one-third of Baby Boomers.

However, consumers ordering preferences do not favor third-party platforms. Consumers of all ages said they prefer to order takeout (32%) and delivery (30%) directly from a restaurant's website or app compared to 22% who prefer ordering on a third-party marketplace for delivery and 7% for takeout, according to William Blair’s report.

However, one thing remains popular for takeout: ordering by phone or in person is a preference for 48% of all consumers. For demographics under 60, 40% said they still prefer this method for takeout,the highest percentage among any other method. Chains like Del Taco, Checkers & Rally’s and White Castle have been testing voice bots for phone orders, while others like Burger King, Taco Bell and Shake Shack have been deploying kiosks to free up in-store labor.

“We continue to believe that demographic shifts and growing comfort with digital channels will drive an ongoing mix-shift toward digital ordering by consumers,” reports William Blair.