Dive Brief:

- Manish Shah, a federal judge in the U.S. District Court for the Northern District of Illinois, granted US Foods default judgment against Boston Market and said the chain’s potential defenses in a lawsuit over unpaid obligations to US Foods were “gossamer,” court records show.

- Shah issued the order granting default judgment on Monday, calling such a move “a harsh sanction” but necessary after Boston Market “intentionally dodged their obligations to the court and plaintiff for months.”

- Shah’s order granted a motion US Foods filed in November, seeking $11.9 million plus per diem interest charges now totaling over $12 million. Boston Market’s attorneys did not immediately respond to a request for comment on the default judgment.

Dive Insight:

According to the order, Boston Market argued that US Foods “overcharged them, didn’t maintain adequate supply, or delivered inferior goods.” The contract between the companies for delivery of goods included provisions for disputes over such issues, Shah said, but Boston Market failed to “offer any evidence or argument that they invoked those provisions.” Boston Market’s claims in its defense, Shah ruled, were generally irrelevant to the matter at hand, which stems from a dispute over Boston Market’s obligations under a purchasing trust set up in accordance with the Perishable Agricultural Commodities Act of 1930 (PACA trust).

“There is no dispute that US Foods delivered goods subject to a PACA trust, Boston Market didn’t pay, and [owner Jay] Pandya was an officer with sufficient authority to subject him to PACA liability,” Shah found.

Shah said the case had come to a default judgment largely as a result of bad faith by Boston Market. Pandya, according to Shah’s order granting the judgment, evaded service on court notices and his company deliberately delayed action and missed deadlines they’d promised to uphold.

“The failure of all defendants to timely attend to this litigation was purposeful, with no valid excuse for delay. Defendants acted in bad faith to avoid this case,” Shah found.

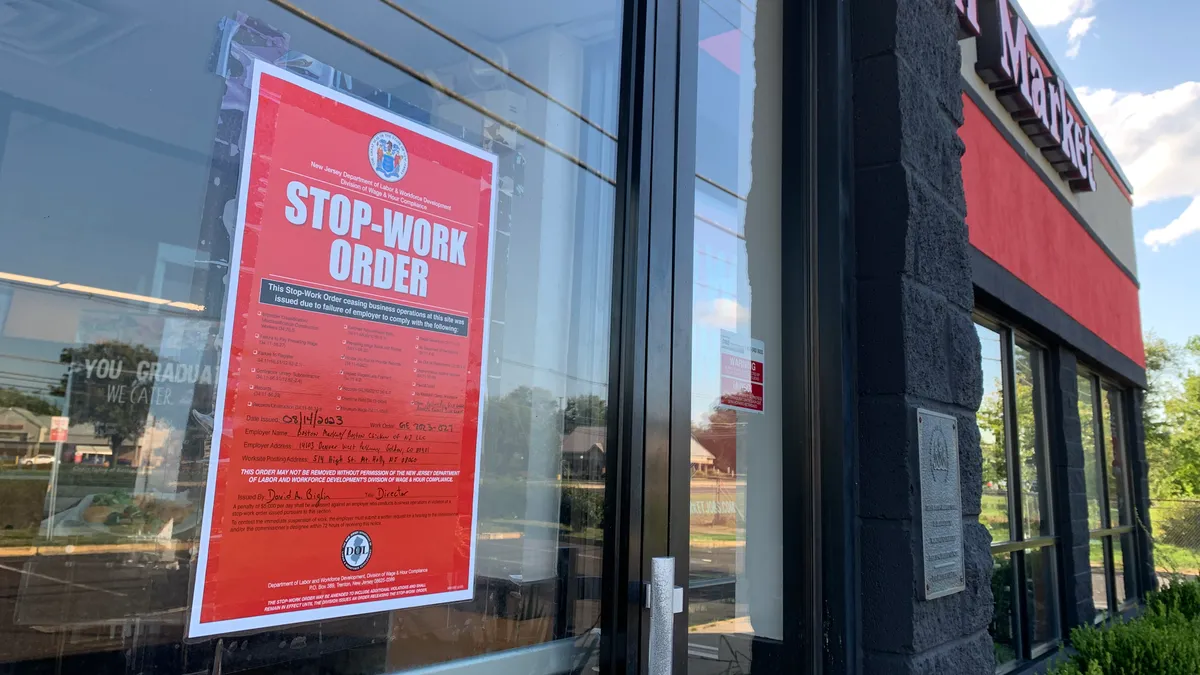

Boston Market has been on the ropes for a while. In August, the New Jersey Department of Labor shut down all the chain’s locations in the state for several weeks over unpaid wages. A landlord in Florida sued the company last spring over unpaid rent, and the Massachusetts Attorney General fined the company $104,000 for unpaid wages and payroll violations last month.

Last May, Colorado seized the company’s headquarters over back taxes. In the face of these mounting troubles, Boston Market rolled out a growth and menu development plan. But the details of the plan, and its effort to add units through partnerships that don’t require buy-ins or the sorts of disclosures associated with normal franchising, raise questions for any potential partners.