When Jeremy Vitaro joined Little Caesars as chief development officer in April 2021, the company was plotting aggressive growth. Since then, the company has signed several multi-unit franchising deals, including agreements with CMG Companies, Chandi Group and Starbeds Legacy QSR. Little Caesars will likely double its rate of new store commitments by the end of the year.

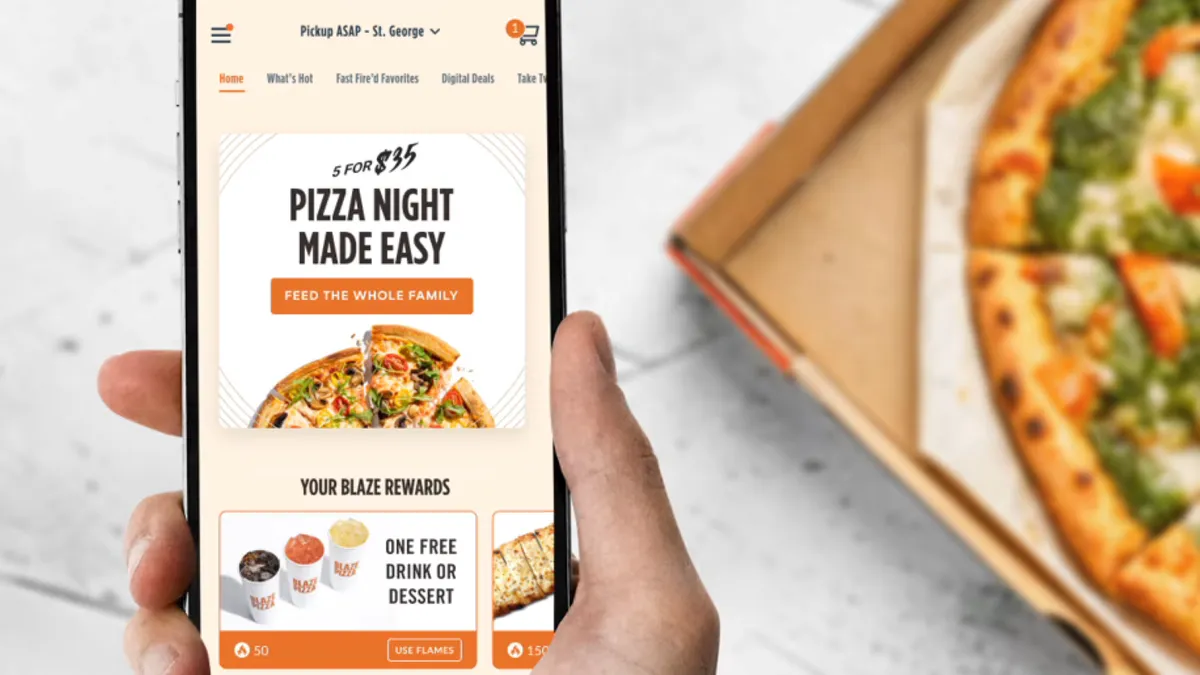

As Little Caesars has invested in technology and diversified its asset mix over the years, it has become more attractive to consumers in urban markets, where delivery and digital are vital channels. In 2018, the chain launched its mobile app and Pizza Portal pickup, allowing customers to order online and collect their pizzas at self-service heated shelves. Then, in 2020, the company launched third-party delivery through a partnership with DoorDash.

“The business model was changing and has changed, and that gave us an ability to go into places and focus on franchising in different geographies and with different people,” Vitaro said.

New York City, the Northeast, Texas, the Southwest and Hawaii are particular areas of interest. Restaurant Dive spoke with Vitaro to learn more about Little Caesars' expansion plans and how its revised business model has helped attract new customers and franchisees.

This interview is edited for clarity and brevity.

RESTAURANT DIVE: What sparked Little Caesars' refocus on growing via franchising?

JEREMY VITARO: We’re a family-owned private company, and we haven't historically tended to talk as much about our accomplishments and where we wanted to go, even as some other brands have. So I think part of it was, let's share more of our great story and great progress and be a little more open to share how we're doing. So I think that that was part of it.

VITARO: We’ve also been fortunate to see a lot of success over the last couple of years, and the pizza industry, in general, performed well during the pandemic. We didn’t launch delivery until right before the pandemic with the Super Bowl in 2020. And it was fortuitous timing. Delivery and digital through the app and pickup on our pizza portal really helped us start to transform the business and go into areas and demographics that we previously weren’t as focused on.

Why did Little Caesars originally think it couldn’t serve certain demographics?

VITARO: We have a model that is really successful with carryout. We went into higher-income areas, as well as high-density urban areas where other brands were using delivery and we weren't. I think not having that delivery and not having the digital until four or five years ago limited our ability to feel like we could be a success. As we’ve added those things, it's really opened up those consumers in areas where they may tend to prefer delivery and want customization on their pizzas more than the traditional, hot-and-ready model.

What has helped attract more multi-unit operators versus Little Caesars’ original focus of single-unit entrepreneurs?

VITARO: We're still focused on both. We want to make sure we continue to be a place where somebody can come in through purchasing or developing one or two restaurants and then grow those over time. Some of our biggest, best franchisees today are those groups that have grown progressively over time.

The multi-unit groups continue to seek opportunities for brands that are scalable and have efficient business models, and ours fits that bill. It’s a very high transaction model. It's very scalable across geographies in ways that many other brands aren't. It’s really efficient from a labor perspective, which has become more and more important today. The diversity of the asset types that we offer is more attractive to the multi-unit groups. A significant portion of our portfolio is drive-thrus. We also have stores without drive-thrus and non-traditional stores. I think that asset mix and the ability to use different investments, sizes and shapes of assets is unparalleled in the pizza industry.

What makes your labor model so efficient?

VITARO: Having an efficient carryout model...has been part of it. We don't have an in-house delivery system, and we rely on DoorDash to handle the delivery, whether it's ordered through our app or ordered on the DoorDash app. I think that's been a great partnership for us at a time when labor is challenging from a delivery driver perspective. With our Pizza Portal, customers can order online and pick up their orders themselves without having to wait at the counter.

What drove your push into large, more competitive markets like New York City?

VITARO: The use of new technology, things like mass mobile data, for example, allows us to identify areas within the markets where there's still strong development pockets. We will continue to use technology to identify those pockets where we can be successful. That's more within existing markets. As we go into newer markets or markets where we have a smaller presence, it's more obvious where there is opportunity, but it's also challenging to make sure you're successful there.

Digital and delivery, but delivery in general, are certainly helping us in areas like New York City, which historically can be a challenging market for a restaurant that doesn't offer delivery. The urban consumer may tend to prefer delivery, prefer that order on the go and pickup model. The customization that's now available in our system all gives us comfort that we can succeed there.

Some of the new national partnerships that we've been doing help us expand our reach to have consumer visibility in areas maybe we previously hadn't. The Call of Duty partnership where we've partnered with Mountain Dew on a product bundle, and the NFL partnership where we’ve got 100-plus million fans of the NFL are some examples.

How have you been approaching international expansion?

VITARO: It is a little bit different, and certainly there are similarities to U.S. business in terms of building upon strong relationships and taking the time to help folks understand the brand. It takes even more patience and understanding internationally because the brand may not be as known in certain parts of the world. Within Latin America, we've already built a very strong business and will continue to grow upon that. We have a lot of opportunities in South America, in particular. It’s a little more incremental. It's building upon the success that we already have, and extending and working on building an even stronger supply chain and marketing structure, etc.

We opened our first stores in Western Europe in late 2019, shortly before the pandemic in Spain, and we've got nine stores opened up today in both Barcelona and Madrid. From there, we've signed deals to enter other markets — Portugal and the U.K. are both opening toward the very end of this year. It's really exciting, but it's also challenging to enter new markets. It is about preparing well, making sure we’ve built out that supply chain structure, which we have within the European world, and planning out the marketing side in terms of how we gain visibility. To do that, we have to outline how the brand’s grown over time in the U.S, how it’s grown over time in other markets, and build upon the relationships that my team and I bring from other brands.

What are some challenges the company has faced and how has it overcome them as it grows?

VITARO: Internationally, building out a strong supply chain is always critical. Doing that in advance is very important. We’ve taken the time to identify proper local suppliers and analyze each product element or equipment element. Then we decide if it's more logical to use our well-developed U.S. supply chain structure or if it makes sense to localize. One big part of being successful internationally is getting that right. The strength of the partner, and making sure that we're working with really exceptional groups, is critical both in the U.S. and internationally. Being very careful about who we work with, how we work with them, and knowing what kind of competencies and experiences that they bring is a big part of success both in the U.S. and internationally.

From a brand awareness side, building the right campaign to make noise locally and make your brand relevant quickly and early is challenging. We’ve gotten better and stronger there over time, and we certainly know that we need to build upon our value credentials. In every market, our strength tends to be value. That’s part of who we are, and we make sure to communicate that early. And that's certainly true in the U.S., but as we go to international markets, that's also true and that's really a strength of ours, and we need to market that effectively.

How have you overcome construction and real estate development challenges in the U.S.?

VITARO: We have an ability to get really active on the equipment side and hold inventory and make sure that we're ahead of things, like walk-in cooler shortages and oven shortages, that the whole industry has been facing over the last year or so. I get a sense that these problems are easing a little bit now. On the equipment side, we've got a really good support team. The folks that we brought in from outside have helped bolster the support that we're giving our franchisees on the real estate selection side and the construction side.

We continue to look for ways to make the restaurants more efficient and more appealing from a design perspective, without losing our value engineering essence. We make sure we never price ourselves out through the use of certain materials, etc. We have to always stay cost effective. We’ve continued to work on smaller models. The pizza portal has helped us do that. Delivery has helped us do that. We’re quite versatile in terms of the models we can use. A pickup window can be a very effective instrument for us, but it's not essential. We can also be very successful without that as long as the real estate is placed in the right locations.

How do you expect Little Caesars to grow in the next five years?

VITARO: We have a lot of opportunities. We’ve built a team, and the technology and franchisees that have come on board will allow us to continue to accelerate. Some of that will be through new markets, like a bigger presence in the Northeast, for example, as well as entering new countries. Some of that will just be within the existing markets and going into new trade areas that we previously neglected. I really see a lot of growth for us in our existing markets. What's exciting to me is not only are we bringing great outside talent with some of the new groups that have come in, but our existing franchisees have really accelerated their pace of growth. And we've got a big base of existing franchisees and really good folks. I spend a lot of my time out at meetings and individual tours and markets getting to know the operators and understand their concerns and how we can help. But I also help them understand where we're going and that it's an exciting time.