Dive Brief:

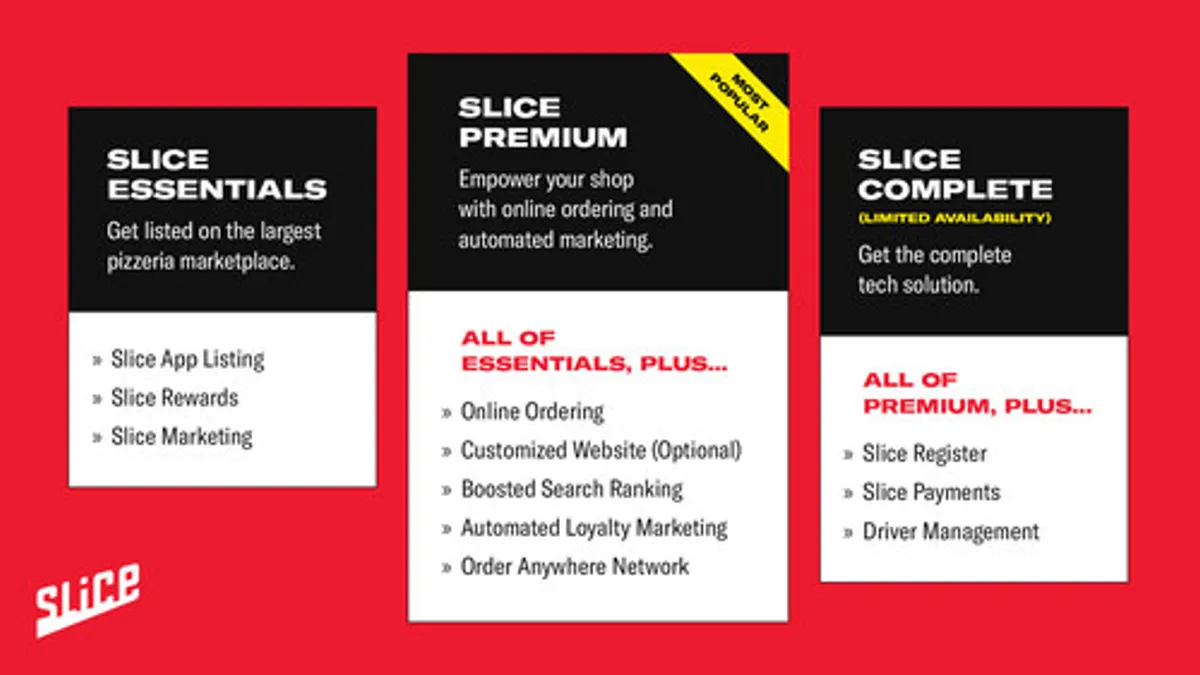

- Slice has added new tiered packages for independent pizzerias on its platform, including "essentials," "premium" and "complete" models, which are each offered on a fixed-cost per order model, according to press release.

- Slice's essentials model includes a listing on the Slice app, Slice rewards and Slice marketing. The premium and complete models include access to online ordering, a customized website, boosted search ranking, automated loyalty marketing and an "order anywhere" network. Complete also includes POS system Slice Register, Slice Payments and Slice Driver Management. Pizzeria operators can also level up to a complete point-of-sales system that unifies online and offline ordering.

- These new packages are the latest of several other features introduced by Slice in the past few months. Slice introduced Slice Register for pizzerias in March, for example, and added Slice Payments and Slice Delivery Management in June.

Dive Insight:

Slice's new pricing model provides operators with the flexibility to scale up or down depending on their current needs. The platform claims its fixed-cost per order model has saved its partner pizzerias over $265 million that would have otherwise gone toward commission fees if they were processed through a third-party delivery app.

Slice's marketing support and tech rollouts also hints that the future of delivery platforms will stretch beyond delivery fulfillment — a trend reflected by DoorDash's tiered commission fee structure in which the higher levels offer more marketing benefits, like access to the DashPass loyalty program.

Slice's succession of new-feature launches are the product of its recent funding hauls, including $40 million in April and $43 million in May 2020. Slice is using this funding to try and level the playing field between major pizza players and the 16,000 independent pizzerias on its platform.

Major players like Domino's and Papa John's have been thriving during the pandemic thanks to their robust digital infrastructure. Domino's same-store sales in the U.S. jumped nearly 20% in Q2, for example. Domino's CEO Ritch Allison said on an earnings call that his company and other large players are taking market share from independent pizzerias.

However, PMQ reports that total sales for independent pizzerias rose 0.58% in the October 2019 to September 2020 period. A September 2020 report from BTIG also notes that independent pizza operators on Slice have doubled their weekly sales during the COVID-19 crisis. Slice's new tiered pricing structure could provide an even bigger boost to these operators by offering marketing benefits previously monopolized by major pizza players.