Dive Brief:

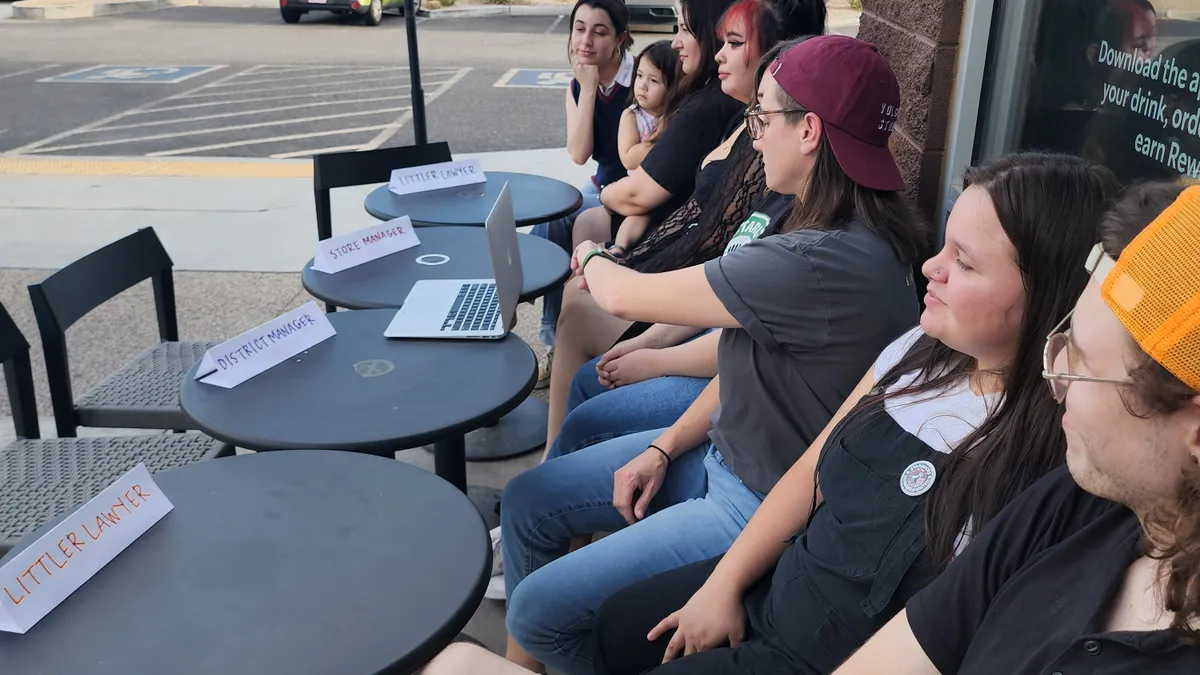

- Starbucks may have failed to properly disclose to investors the impact of unused money on gift cards, or breakage revenue, according to a 16-page letter to the U.S. Securities and Exchange Commission. The letter was sent by the Strategic Organizing Center, a labor federation that includes Workers United.

- Starbucks said it generally recognizes gift cards as deferred revenue, and counts gift cards and rewards points as realized revenue once customers spend it. But the company recognizes a certain percentage of unspent gift card money as breakage, or money it does not expect consumers to ever spend.

- The SOC highlighted breakage as a factor in Starbucks’ ability to meet earnings estimates in recent quarters, and argued the company’s disclosures regarding breakage leave investors with insufficient information.

Dive Insight:

This breakage’s contribution to Starbucks’ margins made it materially important to investors, said Michael Zucker, executive director of the SOC. He argues the coffee chain should report its breakage rates quarterly, rather than annually, and provide more detail on the calculations involved.

“Breakage revenue is basically the company assigning a certain amount of money that doesn't have any cost of goods sold associated with it. So it's always impactful to the bottom line profitability of the company,” Zucker said. “We think it should be reviewed closely and disclosed fully by the company.”

At issue is a change to Starbucks’ accounting standards predating the COVID-19 pandemic and the Starbucks Workers United Campaign. According to a Cowen report cited in the labor federation’s letter, Starbucks shifted from counting breakage in the “Interest income & other” category, and started counting it as a portion of store revenue.

“Breakage is recognized proportionally as gift card redemptions occur, whereby the hypothetical redemption of a $25 gift card results in the recognition of $25 of revenue + $x of breakage revenue, with the revenue being recognized in the segment the store is located and ‘$x’ being determined by various assumptions by the company,” Cowen reported. Those assumptions include historical redemption rates, applicable local laws regarding unspent gift card funds, and when and through what channel a stored value card was activated.

The labor federation found that breakage accounted for more than 3% of Starbucks’ net earnings in 2021 and 2019 each, and 12% of net earnings in 2020. According to Starbucks’ 2021 10-K, the company recognized about $164.5 million in breakage revenue in fiscal 2021. The 10-K for 2022 is not yet available.

Further, the SOC letter asserts that breakage has played a key role in Starbucks’ ability to meet consensus earnings expectations, accounting for $0.12 EPS in 2021, when the company beat earnings consensus by $0.01 EPS. In September of this year, Starbucks faced a class action lawsuit seeking to make it easier for customers to redeem unused gift cards for cash, after a customer was unable to redeem a partially depleted gift card for money at a Boston-area Starbucks, according to The Seattle Times. The company settled out of court earlier this month.

While SBWU is a member of the SOC, Zucker said the union had not asked the federation to look into Starbucks.

Although the SOC didn’t suggest Starbucks violated any laws or accounting procedures, Zucker did say the company’s conduct during the campaign, including a large number of alleged labor law violations, raised questions about corporate control.

“I'm not saying that we think that they've broken securities laws here, but I think that when you're breaking labor law like that, you know, what are the control mechanisms in your company on everything?” Zucker said.

Starbucks has consistently denied that it violated federal labor law in any of the instances in which the National Labor Relations Board and the union have formally accused the company of unfair labor practices.

A Starbucks spokesperson said the company had no further comment on the issue of breakage and deferred revenue beyond what was included in Starbucks’ 2021 10-K report.