Brief:

- Uber Eats today announced its first in-app advertising format, giving restaurants a way to promote their menu offerings. The food delivery service's sponsored listings have seen a return on ad spend (ROAS) of five times in early tests, according to details the company emailed to Mobile Marketer.

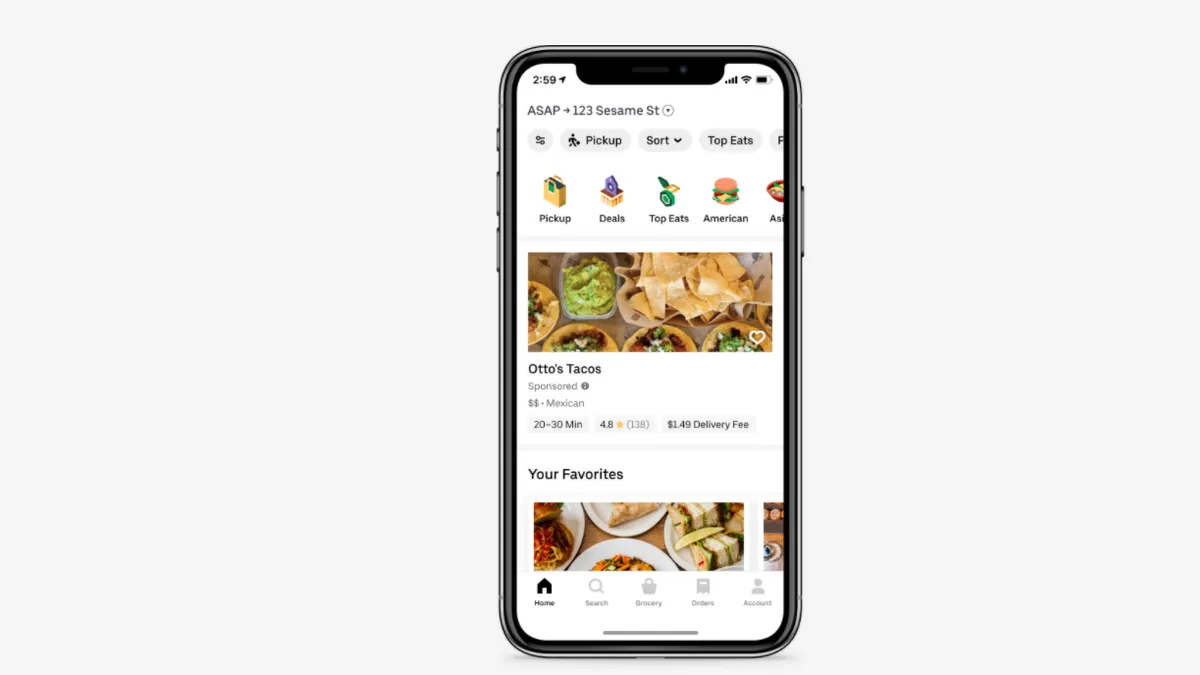

- With Uber Eats' cost-per-click (CPC) pricing model, restaurants only pay when an app user clicks on the sponsored listing, which appears at the top of the app's home feed. Uber Eats has a self-serve ad platform that lets restaurants target their ads based on the location, order history and dietary preferences of Uber Eats customers.

- To encourage restaurants to test the new format, Uber Eats is offering $25 million in marketing credits to small and medium-size businesses that may be facing challenges as pandemic lockdowns limit indoor dining in many regions. Qualified restaurants and enterprise merchants must opt into the sponsored listings to receive the marketing credits, per the announcement.

Insight:

Uber Eats' entry into the mobile advertising market aims to help restaurants reach target consumers when they're in-app and most ready to order food. More than a third of U.S. adults have ordered food online or through an app from a local restaurant during the pandemic, a Pew Research Center survey found. That percentage is even higher for younger adults, with 53% of people ages 18 to 29 saying they've placed at least one restaurant order because of the outbreak, giving Uber Eats a potentially significant audience for its sponsored listings format. While food delivery may subside somewhat as restaurants reopen their dining rooms at limited capacity, it's likely to remain elevated among consumers who are less willing to dine out.

The early ad metrics for Uber Eats' sponsored listings appear promising for restaurants, especially small- and medium-sized businesses that have limited marketing dollars amid pandemic-related financial pressures. The ability to target customers based on their location and order history is significant in boosting the ROAS for restaurants, while Uber Eats' CPC pricing model helps to lessen the cost of ads that don't generate a response from app users. By offering marketing credits to smaller businesses, Uber Eats is giving financially strapped restaurants a chance to test sponsored listings and hone their marketing strategies to generate stronger returns.

The introduction of sponsored listings comes almost a year after Uber Eats indicated interest in growing its ad revenue by posting a job listing for a group product manager for ad sales. Before that, the delivery company had tested native advertising in India, giving greater prominence to restaurants that bundled food and sold it at a discount for delivery.

This year, Uber Eats has become a bright spot for Uber as the pandemic hurts demand for ride-hailing services. Uber Eats bookings surged 106% to $6.96 billion in Q2 from a year earlier, contrasting with the the 75% plunge in bookings for ride-hailing services, per its quarterly report. By adding sponsored listings to Uber Eats, the company can diversify its revenue and monetize its audience of app users.